Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

What Is the Average Cost of Homeowners Insurance in Florida?

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

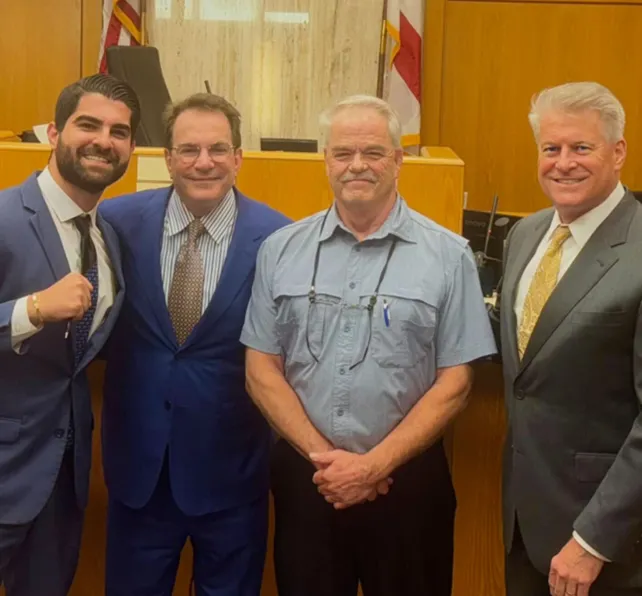

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

In the Community

Discover the local Morgan & Morgan experience with news, events, and partnerships.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

What Is the Average Cost of Homeowners Insurance in Florida?

The average cost of a homeowners insurance policy in the United States is $1,312 based on $250,000 in dwelling coverage. Bankrate reviewed the latest data to calculate the national average, as well as the average for each of the 50 states. The Bankrate insurance editorial team analyzed average premiums that the organization acquired from Quadrant Information Services. Data came from 142 insurance companies that operate in a little more than 35,000 zip codes.

Florida’s average annual premium for homeowners insurance sits at $1,353, which is slightly above the national average annual premium. The $1,353 average annual premium translates into an average monthly premium of $113. Floridians spend an average of 2.32 percent of their household incomes on homeowners insurance.

Calculating the average cost of homeowner’s insurance in Florida involves analyzing each of the components of a policy and understanding the risks of a home sustaining significant damage.

What Are the Main Components of a Homeowners Insurance Policy?

Every homeowners insurance policy contains specific protections that prevent a substantial financial loss because of a disaster such as a fire, theft, or hurricane.

Dwelling Coverage

Dwelling coverage should match the value of rebuilding the same home, which is often referred to as the replacement cost value of your house. This type of coverage pays for covered damages up to the dwelling coverage limit listed in your policy. Dwelling coverage includes the primary structure, as well as an attached structure like a garage or a guest house.

Other Structures Coverage

Other structures' coverage typically consists of up to 20 percent of your dwelling coverage limit. It covers damage to structures such as sheds, guest houses not attached to your home, and other structures that sit on your property.

Personal Property Coverage

Taking up to 75 percent of your dwelling coverage limit, personal property coverage protects your possessions that include clothing, appliances, and electronics. You can expand personal property coverage by purchasing additional coverage limits. Depending on the terms written into a policy, you might have the option to choose between cash value coverage and replacement cost coverage.

Personal Liability Coverage

Usually running between $100,000 and $500,000, personal liability coverage covers medical expenses and the property damage sustained by other parties while on your property. Personal liability coverage also should include coverage for legal fees in case you face a personal injury lawsuit.

Medical Payments Coverage

You can increase the amount of money to pay for the medical expenses of the parties that sustained injuries while on your property. The amount of medical payments coverage typically runs between $1,000 and $5,000.

Loss of Use Coverage

As a type of coverage that can comprise 20 percent of your dwelling coverage, loss of use coverage pays for living expenses if you have to relocate from your damaged home. The most common expenses covered by loss of use coverage are hotel-related expenses.

The amount of money funded for each component determines the average cost of homeowners insurance in Florida.

What Risk Factors Contribute to the Average Cost of Homeowners Insurance in Florida?

As with car insurance, insuring your home represents a financial gamble taken by an insurance company. Many factors play a role in determining the average cost of homeowners insurance in Florida.

Age

Older homes require more money to insure because repair costs run higher than the costs of repairing newer houses. Replacing and repairing customized molding, wood floors, and plaster walls might require the expertise of specialists, which increases the cost of insurance.

Condition of the Roof

Older roofs might not remain in mint condition after a thunderstorm that produces hail and high wind damage. The type of material uses to design and construct a roof also determines the average cost of homeowners insurance in Florida. Some types of roofing materials remain intact after the passing of severe weather.

Building Code

Many policies do not pay for the expenses associated with ensuring a damaged structure meets the guidelines of the current building code. You might have to pay for optional ordinance or law endorsement coverage to cover the cost of following your city’s building code standards.

Amenities

Amenities like a sauna and swimming pool increase the value of your home, but the amenities also increase the average cost of homeowners insurance in Florida. Houses that include recreational amenities require an increase in liability coverage to protect against the financial losses that occur when a guest suffers injuries on your property.

Weather

Standard homeowners insurance policies do not cover flood damage, especially if a home is located in a designated flood zone. The same principle applies to earthquakes. Although Florida is not known for earthquakes, the Sunshine State is known as the most active state for severe tropical storms. Florida also experiences the most lightning strikes of any other state.

Fire

Despite the Sunshine State’s reputation for a humid climate, the state also experiences droughts that can lead to the development of fire hazards. According to the Insurance Information Institute (III), structure fires caused more than $12 billion in property damage in 2019. Insurance companies value fire coverage based on the geographical location of a home, as well as how close a house is to the nearest fire hydrant.

Crime

Crimes such as theft and vandalism can cause a significant amount of damage to a home. The crime rate calculated for the neighborhood and city where you live is a factor in determining the average cost of homeowners insurance in Florida.

How Can I Reduce the Cost of My Homeowners Insurance Policy?

One of the most effective ways to decrease the cost of homeowners insurance involves bundling homeowners insurance with a car insurance policy. Most insurers offer discounts to customers that purchase both types of insurance. Conducting research online can help you save money on homeowners insurance. You have access to several sites that present cost comparison charts for different homeowners insurance policies. Simply asking for a discount might save you money as well.

Increasing your monthly deductible reduces your monthly premiums, but you have to be careful not to expose yourself to substantial out-of-pocket expenses. Make sure to select the types of coverage that match your needs. Some insurers try to hard-sell customers into selling coverage they do not need. Improving your credit score makes you less of a financial risk, which can lead to a lower monthly premium. Completing home improvement projects makes your house less vulnerable to sustaining damage, which lowers your risk of requiring financial help for repair work.

What Are the Most Common Types of Homeowners Insurance Claims in Florida?

Because of its location, Florida homeowners are susceptible to several types of severe weather that include tornados and hurricanes. The following types of events represent the five most common homeowners insurance claims filed in Florida:

- Wind

- Hail

- Lightning

- Water

- Sinkhole

Sinkhole Claims

In March of 2013, a home fell into a massive sinkhole located in a suburb of Tampa Bay. Although the formation of sinkholes is considered relatively rare by geologists, Florida ranks as one of the states that experiences the most sinkholes. The reason for the large number of sinkholes forming in Florida is water inundating the sandy composition of the soil found in many areas of the state. Many insurance companies either do not cover sinkhole damage or charge premiums that most homeowners cannot afford.

How Does a Morgan & Morgan Attorney Help Me Resolve a Homeowners Insurance Dispute?

The homeowners insurance claim process can be frustrating, from experiencing a delay in payment to having a claim denied for an invalid reason. Working with one of the highly-rated homeowners insurance lawyers from Morgan & Morgan can help boost your chances of getting a claim approved.

One of our attorneys reviews the terms of your policy to determine what coverage is included with your policy. Before you file a claim, your legal counsel examines the claim information to ensure you submit a persuasive case for compensation. Gathering and collecting evidence such as copies of repair receipts and photos of your home after a disaster is an important part of filing a convincing homeowners insurance claim as well.

Some insurance companies implement unethical business practices, which one of our lawyers can detect to prevent your claim from getting denied. An experienced insurance lawyer negotiates with your insurance company to get you the most favorable settlement. If your legal counsel cannot negotiate a favorable settlement, then the next step involves filing a civil lawsuit that seeks monetary damages.

Schedule a free case evaluation today to resolve the homeowners insurance dispute you have with your insurance company.