Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Insurance Attorney in St. Augustine

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

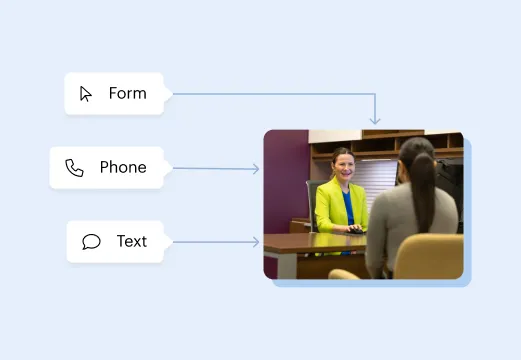

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

Insurance Company Reasons for Denying Claims

Insurance providers are motivated by self-interest (the cash reserves of the company) to avoid or minimize payouts. Some insurance companies employ various tactics to delay payment, reduce the amount paid out, or avoid paying a claim altogether. Providers may interpret or manipulate the language of a policy to serve their own purposes. Insurance companies may claim:

- The injury for which the claim is made falls outside the scope of the policy coverage.

- Coverage lapsed when the policyholder failed to pay premiums on time.

- There was a material misrepresentation in the policy, which excludes coverage on the claim in question.

Types of Insurance Disputes We Handle

Our insurance lawyers at Morgan & Morgan have years of experience representing policyholders in a range of insurance disputes, including:

- Auto insurance coverage

- Uninsured motorist coverage

- Personal injury protection (PIP)

- Health insurance claims

- Medical billing

- Homeowner’s policies

- Business property loss

- Disability insurance

- ERISA claims

- Professional liability coverage

- Errors & Omissions coverage

- Life insurance

- Fire, hurricane, and windstorm claims

Insurance Bad Faith and Unfair Claims Handling

Insurance policies act as contracts. Policyholders agree to pay premiums, and insurance companies agree to pay claims unless policy exclusions apply. Parties to any contract must act in good faith and enter into the contract with sincere and honest intentions. When an insurance company denies a claim without a legitimate reason, it may be acting in bad faith.

Most states, including Florida, have adopted the Unfair Claim Settlement Practices Act, which helps protect policyholders against unfair claims handling, examples of which include:

- Deceiving or misleading a policyholder

- Fraud

- Neglect or refusal to fulfill a contractual obligation

- Conscious wrongdoing

St. Augustine Insurance Claim Lawyers

Our dedicated attorneys at Morgan & Morgan take pride in the fact that we represent people – never insurance companies, hospitals, or large corporations. We are committed to pursuing the best possible outcome for our clients, and it shows in the results we have achieved.

If your insurance company has ignored or refused to pay a legitimate claim or substantially minimized the payout, contact us for a free case evaluation. We have the skills and knowledge to stand up for your rights if your insurance company has treated you unfairly.