Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Overtime Attorney in Tavares

If your employer denied you overtime pay, we fight to recover your lost wages and ensure fair compensation for your work.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

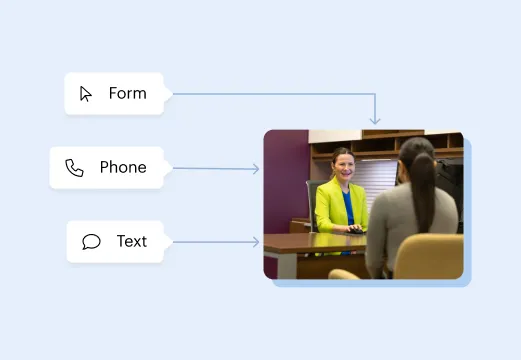

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

How Employers Deny Employees Overtime

Wage theft can take a few different forms, and in some cases it may not even seem like employers are doing something illegal.

Some common forms of wage theft include:

Misclassifying Employees: Employees can be classified as non-exempt and exempt with regards to overtime. Exempt employees are not entitled to overtime pay. As such, at times employees will misclassify employees as exempt to avoid paying them a fair overtime wage.

For example, if your employer has classified you as a managerial employee who is not entitled to overtime, but your job duties are primarily non-managerial in nature, you may be entitled to overtime. Importantly, just because an employee has a “white collar,” salaried position does not mean he or she is exempt from federal overtime requirements. This misclassification is a blatantly illegal attempt to cut costs.

Paying Fluctuating Workweek: An employer can use the fluctuating workweek method (also sometimes referred to as “Chinese” overtime) only if certain criteria are met. To use the fluctuating workweek method of calculating overtime, employees must be paid a fixed weekly salary, even if they work less than 40 hours in a given week. If your pay is being reduced when working under 40 hours despite being told you’re being paid under the fluctuating workweek method, your employer could be violating the law.

Manipulating Calculation of Hours Worked: If your hours vary from week to week, you’re still owed proper pay for the overtime you did in a given week. For example, if a worker put in 50 hours in one week and then 30 hours the following week, the employer may not average the hours over two weeks to deny overtime for the week the employee worked 50 hours.

Enforcing Policies to Illegally Reduce Hours Worked: Some employers will even mandate policies that prohibit employees from working overtime, convincing employees that they cannot be owed overtime. This can include:

- A straightforward “no overtime” policy;

- Unpaid lunch breaks;

- “Off the clock” policies;

- Failure to pay for training or at-home work;

- Unpaid bag checks; and

- Failure to pay workers for time spent putting on or taking off safety gear.

What an Attorney Can Do to Help

With so many different ways employers try to work the system and avoid paying employees a fair wage, it becomes more and more important for employees to know their rights. If they are not sure about if they are the victim of wage theft it may be time to contact an experienced wage & hour attorney.

If an employer does not properly compensate you for all hours worked, an attorney can help you file a claim under the Fair Labor Standards Act to recover unpaid wages. These claims may permit you to recover double the amount of damages you incurred as a result of the wage law violation, attorneys’ fees and related legal costs.

Morgan & Morgan Attorneys May Be Able to Help

If you have been denied overtime pay by your employer, you may have legal options. Morgan & Morgan has experienced wage & hour attorneys who understand the specifics of overtime law. To learn more about your options and how an attorney may be able to help, fill out our free case evaluation form today.