Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Hurricane Insurance Cost in Florida

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

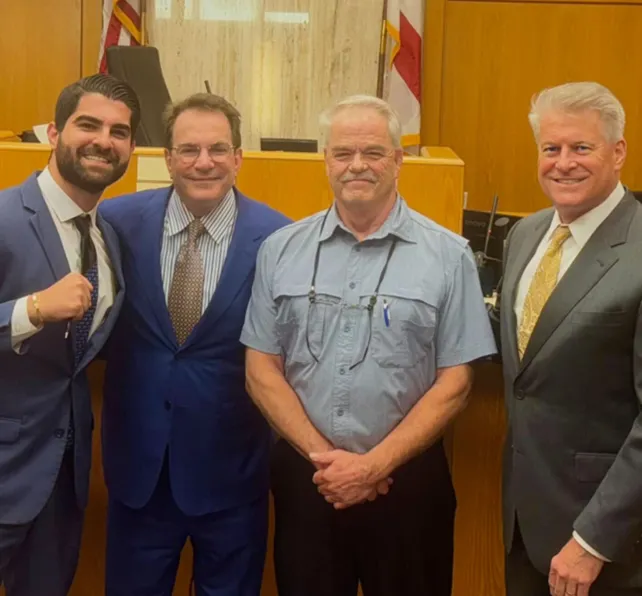

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

In the Community

Discover the local Morgan & Morgan experience with news, events, and partnerships.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

What Is Hurricane Insurance?

Hurricanes yield two major problems: wind and water damage. Generally speaking, there is no such thing as “hurricane insurance,” or a specific policy that Florida homeowners can purchase to protect against these storms. Instead, a combination of homeowners insurance – which by law includes coverage for wind damage from hurricanes – and flood insurance provide the required protection.

How Much Does Hurricane Insurance Cost?

For many reasons, it’s difficult to estimate how much money it will cost to protect your home against hurricane damage. Among them:

- Hurricane coverage consists of multiple insurance policies, each of which can vary in cost

- Prices fluctuate from one carrier to the next

- Some parts of the state are considered higher-risk

- Home values affect the cost of coverage

However, the average cost of homeowners insurance in Florida is $1,951 and the average cost of flood insurance is $723, according to Bankrate. Therefore, on average, Florida homeowners pay approximately $2,674 per year in premiums to protect against hurricane damage.

In addition, all Florida homeowners are subject to a special deductible for hurricane damage. This deductible is triggered by losses resulting from a hurricane that’s been declared as such by the National Weather Service. Losses apply to damages:

- That occur from the moment a hurricane watch or warning has been issued anywhere in the state;

- Up to three days after a watch or warning ends; and

- Any time hurricane conditions are present throughout the state

The deductible – which applies once per hurricane season – is based on a percentage depending on the degree of risk to the property. Insurers in Florida must offer deductible amounts equal to $500, 2%, 5%, and 10% of the policy dwelling limits (unless the percentage deductible is below $500).

The insurance company won’t pay for any damages until the deductible has been reached.

How Can a Hurricane Insurance Lawyer Help?

Even if you do everything right when filing your claim, the insurance company might still make it difficult to recover compensation. Ultimately, the insurance company’s goal is to protect their bottom line, which is at odds with your best interest. They may employ tactics such as:

- Delaying the processing or payment of your claim

- Making inadequate offers that fail to address all of your damages

- Demanding that you sign a written release of supplemental claims before they pay your claim

- Arguing that certain damages are not covered by your policy, even though they are

- Attempting to convince you that an inadequate offer is the best outcome you can hope for

It’s important that you have a law firm on your side with the resources and know-how to navigate these challenges. With more than two dozen offices across the state of Florida, Morgan & Morgan is uniquely positioned to handle virtually any insurance dispute. We understand how to decipher the true value of a claim and are ready to fight to recover the full restitution you are owed.

Contact a Hurricane Insurance Lawyer

If the insurance company has rejected or undervalued your claim, contact Morgan & Morgan. We take pride in holding insurance companies accountable, and may be able to assist you in recovering the compensation you need to get your life back on track.

Schedule a free, no-risk case evaluation. It costs nothing to hire us, and we get paid only if you win, so there’s no risk to you. Get started now.