Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

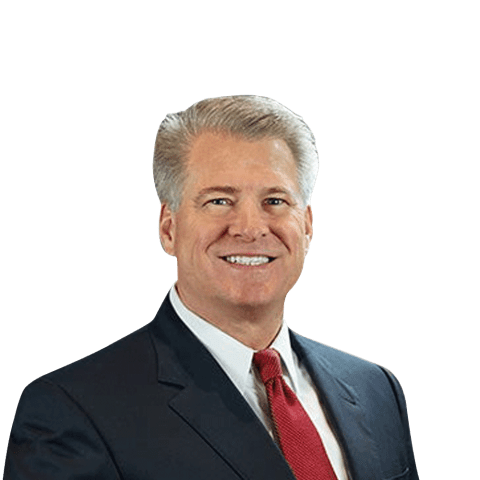

Hurricane Attorney in Orlando

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

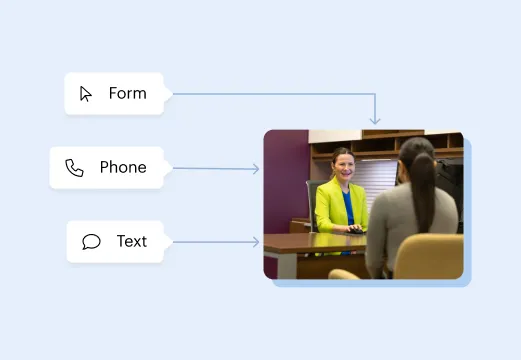

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

How Do I Protect My Home From Flooding in Florida?

Although most major hurricanes cause flooding, hurricane insurance doesn’t generally cover it. You’ll need separate flood insurance to cover damage resulting from flooding.

When purchasing homeowner’s and flood insurance, make sure you find out exactly what your respective policies cover. A qualified hurricane insurance lawyer can carefully examine the contents of your policies to determine which one covers specific damage caused by a hurricane.

Do I Need a Lawyer to Appeal a Hurricane Insurance Claim Denial?

You unquestionably should retain a lawyer if you need to appeal a hurricane insurance claim denial. The insurance company controls the appeals process, and you don’t have a good chance of getting a denial reversed without help from an experienced hurricane insurance attorney.

Ideally, you’ll want to hire an attorney before you’re denied. But even if you don’t, an attorney will know how to fight a denial and increase your chances of getting it reversed.

When Should I Hire a Hurricane Insurance Lawyer?

The best time to hire a hurricane insurance lawyer is as soon as possible after a hurricane damages your home. Your attorney can help you document your losses and file your claim.

Hurricane insurance attorneys have experience working with insurance companies and understand the types of evidence that will best support your claim. Typically, the sooner you hire a hurricane insurance lawyer, the more you stand to receive from the insurance company, and the faster you'll get it.

Can I Hire a Hurricane Insurance Lawyer Before My Home Suffers Insurance Damage?

While there isn’t much purpose to hiring a hurricane insurance attorney before your home is damaged, there may be value in consulting with an attorney before a major hurricane is predicted.

Your attorney can help you document the current state of your home and may even be able to direct you to resources that will protect it from damage. Furthermore, if you’ve consulted with an attorney before a hurricane hits, they’ll be expecting your call after the event and may be able to act more quickly.

If My Car Is Damaged in a Hurricane, Is It Covered by Car Insurance, Homeowner’s Insurance, or Flood Insurance?

Unfortunately, there’s no definitive answer to that question. Which type of insurance covers the damage will depend on the circumstances surrounding that damage and where your vehicle is located.

For example, a situation in which your car is flooded while parked on the street during a hurricane is very different from one in which it’s totaled because your garage collapsed on it. Your hurricane insurance attorney will study your various insurance policies and investigate the circumstances of the incident to determine which insurer should compensate you for the damage.

Can I Purchase Insurance After a Hurricane Is Predicted?

There’s no limit on when you can purchase insurance, but there might be a limit on when the insurance takes effect.

Flood insurance, in particular, is likely not to take effect until 30 days after you purchase the policy. Additionally, if a hurricane watch has been issued for where you live, it’s too late to purchase additional insurance to protect your home.

Can I File a Lawsuit Against My Insurance Company if It Denies My Claim or Undervalues My Claim?

You can file a lawsuit if you feel your insurance company is treating you unfairly. However, this option is best saved as a last resort. Before you pursue litigation, you should allow your attorney to attempt to negotiate a fair settlement with the insurance company.

If you do file a lawsuit, it will probably take a year or longer before the trial ends. The good news is that you’ll often receive more money from a trial reward than you would get from a negotiated settlement.

Also, by filing a lawsuit, there’s a chance that the insurance company will come to the negotiating table in good faith and make a larger offer. Trials are expensive, and it’s usually more advantageous for the insurance company to settle than to pay for a trial.

What Kind of Evidence Do I Need for My Insurance Claim?

The more evidence you can provide to the insurance company, the better. Examples of helpful evidence include:

- Photographs of your possessions, both before and after they were damaged

- Receipts organized by date

- Repair estimates from multiple trusted contractors

- Evidence that a tropical storm or hurricane hit your home, such as photos, videos, or meteorological reports

Remember, you aren’t trying to convince your insurance agent that a hurricane damaged your property. You’ll usually have to convince someone higher up in the company who you’ve never met and may not even live in the same state.

Thus, having copious objective evidence will greatly improve your chances of getting your claim approved and receiving the compensation you deserve.

Is My Home Covered for Hurricane Damage if I Evacuate During a Hurricane?

The most important thing to protect during a hurricane is your family. If you think a hurricane may get bad enough to cause injury to you or your loved ones, you should leave your home and head to a safe place until it’s passed. Doing so won’t invalidate your insurance coverage or prevent you from receiving compensation for the resulting damage.

However, the precautions you take when you evacuate your home could affect your right to compensation.

For example, you should make it a point to turn off the electricity and the main water valve before you leave to minimize potential damage. It’s also a good idea to unplug all appliances and electronics, cover all exposed windows, and bring any loose or lightweight items indoors.

Taking these sorts of proactive measures means the insurance company can’t use your evacuation as an excuse to undervalue your compensation. And since the deductible for hurricane damage is a percentage rather than a flat value, making more of an effort to limit the damage to your home will limit the amount you have to spend on the deductible later.

Regardless of whether you have the time or ability to take proper precautions, you should always evacuate if you have any reason to fear for your safety or that of your family in the run-up to a major storm.