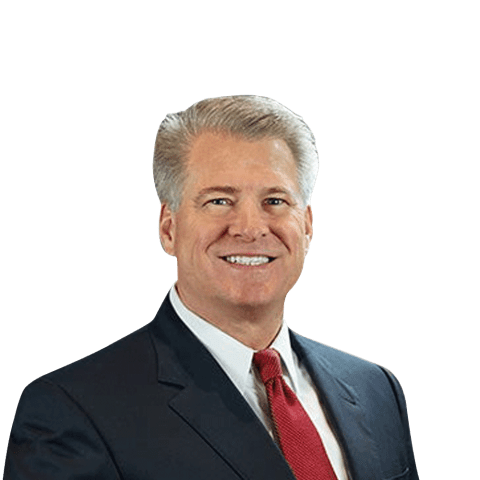

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

How to Collect PIP Insurance in Miami, FL

Fighting for every client with the power of America's Largest Injury Law Firm.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

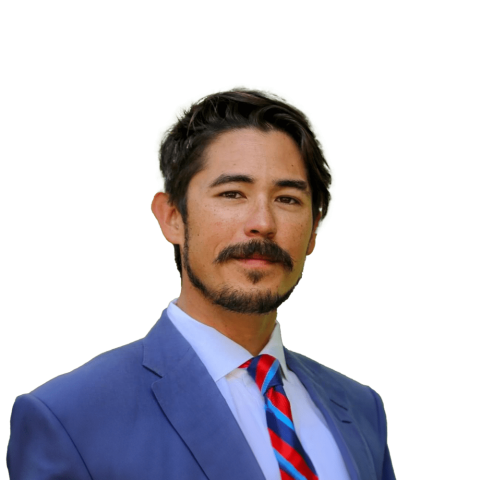

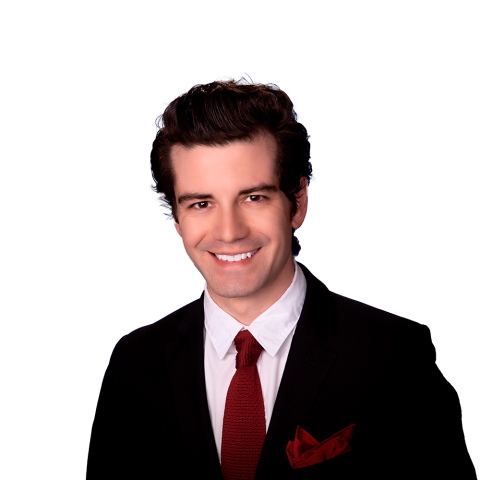

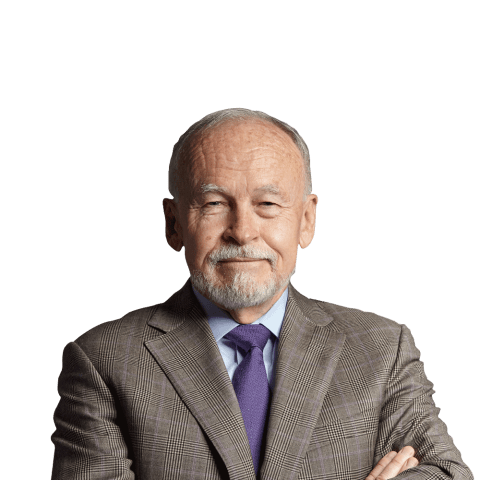

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

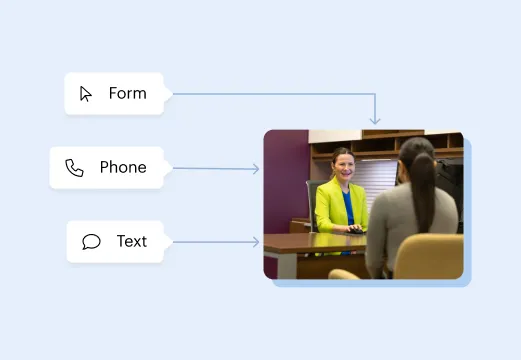

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

What If My Insurance Provider Is Uncooperative?

In some cases, insurance providers may be uncooperative, especially if you don’t submit full documentation related to your claim. Insurance adjusters are busy people, and if they believe your claim is frivolous or doesn’t have the information required to be approved, they may deny it altogether.

That is why it’s important to have the assistance of a qualified attorney who can help you to assemble the required paperwork you need to have your claim approved. You want to be able to receive the appropriate care to recover from any injuries, such as concussions or back injuries, that you are suffering as a result of the collision.

An attorney can also handle discussions with the insurance company on your behalf. Their assistance will include providing evidence of your medical treatment and related expenses, assembling evidence of the accident, and providing copies of the police report.

Will I Need to Pay for Representation Upfront?

Morgan & Morgan works on a contingency fee basis. This means that there are no upfront costs associated with your representation.

During your case review, we will look at the circumstances of your accident and the injuries that you have sustained as a result. If we decide to accept your case, we will not collect any money unless you do. Our earnings are a percentage of the compensation you receive from your insurance provider.

What Can I Do to Recover Compensation from PIP?

The knowledgeable personal injury attorneys at Morgan & Morgan can help you to prepare all of the documentation required for your PIP claim.

Common evidence required may include police reports, evidence of your injuries and their associated treatment, wage statements from your job, and statements from individuals who witnessed the crash.

Submitting a PIP claim requires careful attention to detail. It’s not uncommon for insurance adjusters to deny reimbursement for trivial technicalities.

To ensure that your case receives the attention that it deserves, reach out to our qualified legal team for a free consultation. We will review your case and inform you about the best steps to move forward in the process. Remember, we don’t receive any compensation unless you do. We work to ensure the best outcome for you.