Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Hurricane Idalia Property Damage Lawsuit

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Florida Personal Injury Lawyers

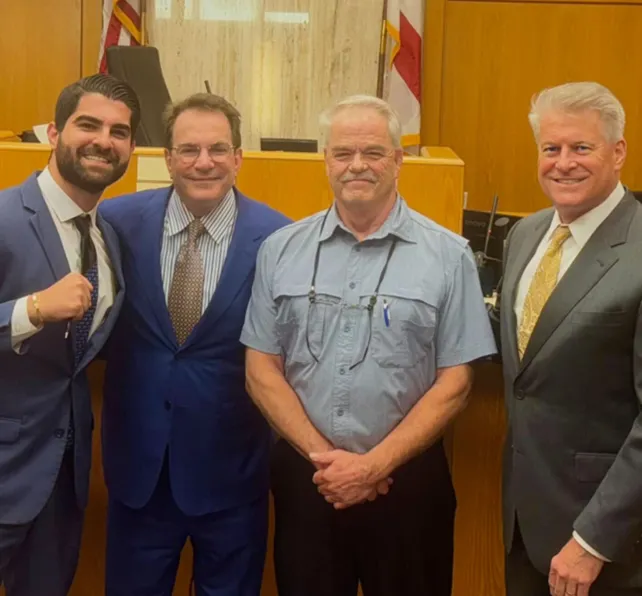

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

In the Community

Discover the local Morgan & Morgan experience with news, events, and partnerships.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

What Should I Know About Hurricane Idalia?

Hurricane Idalia was an extremely dangerous major hurricane that made landfall over Florida's Gulf Coast on August 30, 2023

Its path impacted a wide central portion of the state, including cities such as Tampa and Orlando, and then moved close to the Carolina coastline.

In addition to its powerful winds, storm surges and flooding were an additional point of destruction from the fierce storm.

What Are Some Hurricane Resources I Can Use?

If you are dealing with the aftermath of a severe storm, please find the following helpful resources below.

What Kind of Damage Did Hurricane Idalia Do?

Idalia thrashed Cuba with heavy rain, especially in the westernmost part of the island.

Authorities in the province issued a state of alert, and residents were evacuated to friends’ and relatives’ homes as authorities monitored the Cuyaguateje river for possible flooding. As much as 4 inches of rain fell in Cuba during the storm.

Idalia grew into a Category 3 hurricane as it approached Florida with devastating winds and rain. It left miles of severe damage, displaced many residents from their homes, and in worst cases, led to tragic deaths.

The major types of damage caused by Hurricane Idalia includes:

- Water and flood damage

- Wind damage

- Hurricane storm damage

If your home has been damaged in Hurricane Ian, make sure you get the compensation you deserve. Don’t let insurance adjusters deny you of the coverage you’re owed.

What Are My Options if Hurricane Idalia Caused Damage to My Property?

In Florida, you have just one year from the date the hurricane made landfall to give notice of the claim to the insurance company. Many websites may tell you that you have up to three years, but they are based on outdated information.

For usual property damage claims you have one year from the “date of loss,” but for hurricanes and other weather-related events you have one year from when the event made “landfall.”

It is important to file your insurance claim as quickly as possible to give yourself plenty of time to fight for compensation in case you end up in an insurance dispute.

If your property is covered under your insurance policy, you should not have an issue getting compensated after Hurricane Idalia. However, property insurance companies sometimes act in bad faith, refusing to pay for damage that should be covered under a policy. If you find yourself in this position, don’t hesitate to reach out to Morgan & Morgan. We can help fight for what you deserve.

What Do I Do if My Insurance Claim Is Denied After a Hurricane?

Unfortunately, many insurance companies try to take advantage of customers during a crisis like Hurricane Idalia in an attempt to avoid paying for damages. They often look for any reason to deny claims because they are experiencing what they call an “insurance crisis”—an overwhelming number of claims during a certain period of time. If your Hurricane Idalia insurance claim gets denied, however, you still have options.

Morgan & Morgan can review your case and can help to guarantee that any compensation you are legally owed will be paid out by the insurance provider. If your insurance company won’t pay, we’re prepared to take your case to court.

If Your Insurance Refuses to Offer Fair Compensation for Your Hurricane Idalia Damages, Call Morgan & Morgan

Reach out to Morgan & Morgan if your insurance company won’t supply the compensation you rightfully deserve after your property has been devastated by Hurricane Idalia. With over 35 years of experience and over $25 billion recovered for our clients, we have the size, resources, and know-how to fight for your full and fair compensation.

And as members of the Florida community, we stand by our neighbors who have suffered through this terrible storm. We can provide you with a free case evaluation to review your case and explore your options so that you can get started on your path to recovery.