Results may vary depending on your particular facts and legal circumstances. The attorneys featured are licensed in Kentucky. For a full list of attorneys in your state please visit our attorney page.

OWENSBORO CAR INSURANCE ATTORNEY

Car crashes can derail your life. We've helped thousands of people recover—physically, financially, and emotionally—after an accident.

Results may vary depending on your particular facts and legal circumstances. The attorneys featured are licensed in Kentucky. For a full list of attorneys in your state please visit our attorney page.

Car Insurance Attorney in Owensboro, KY

Most people believe that their insurance providers have their best interests at heart, but that's not always true. It is not uncommon to come across an eligible policyholder who's been denied the compensation they deserve after an accident. Some of these insurance companies are only pleasant to their clients when collecting money from them. But when it comes to compensation, some insurance companies will teach you painful lessons.

If you or your beloved has been denied insurance benefits due to unfair reasons, it's important that you contact an experienced insurance attorney in Owensboro. This is especially true if the claim involves serious accidents such as those caused by vehicles. But given that there are numerous car insurance attorneys and Owensboro, Kentucky, it is understandable that you may find it challenging to choose the right one.

However, that is not something you need to worry about anymore. Your search for the best car insurance attorney in Owensboro, Kentucky, ends here. Morgan & Morgan is the best and largest injury law firm in the United States. When you contact us for a free case evaluation, we will review your case and let you know if you have a valid claim against your insurance company. And if you do, we'll fight for you.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

When Should I Contact Morgan & Morgan Car Insurance Attorneys in Owensboro?

When you submit an insurance claim to your insurance provider, you don't expect them to play games. Instead, you expect them to be empathetic, understanding, and to do what's right, in this case, releasing the insurance benefits you may be entitled to.

But that is not how some insurance companies work. Instead, they may try to frustrate the claims process to avoid paying you what is rightfully yours. And when that happens, it is important that you contact us right away by filling out our free case evaluation form.

Other than declining to compensate you for the damages, the insurance company might use another common tactic - offering unreasonably low compensation. It is never advisable to accept a lowball offer from a car insurance provider or any other insurance company for that matter.

Here's why:

When you get injured in a car accident and submit a claim, a rogue insurer might decide to frustrate the entire claims process. This mostly happens if the accident warrants a significant amount of compensation. For example, if you require multiple surgeries or suffer permanent disfigurement due to the accident, chances are the insurance company will have more than your medical bills to worry about. You may be able to claim lost wages, pain and suffering, lost earning potential, caregiving costs, and so much more.

Insurance companies will not just write you a check because you've been paying your monthly premium on time. Instead, they may decide to hire a claims adjuster. Remember, the primary role of an insurance claims adjuster is to evaluate a claim and adjust it accordingly to reflect its true value.

But the truth is, they don't usually play fair because they work for insurance companies. So while they might seem understanding during the initial phone call with you, it's important to bear in mind that they only serve the insurance provider's best interest.

In this case, the insurance provider's best interest is to avoid paying you what you are entitled to per the terms of your insurance contract with them. On the other hand, your best interest is that you receive the treatment you need and deserve after the accident, including other benefits you may be entitled to as per your insurance contract.

For this reason, you need someone to fight for you as you focus on recovering from your injuries. That's where our car insurance dispute attorneys come in to provide the legal representation you need to prevent the other party from bullying or exploiting you or your loved one.

Remember, when you sign the release of settlement agreement, you can't reopen the claim unless under extraordinary circumstances. A good example of such a scenario is if the insurance company committed fraud during the process or if they tricked you into signing the agreement. But, of course, this isn't the easiest thing to prove, and that's why it's always advisable to get things right the very first time by consulting an attorney when the insurance company begins to play games with your claim.

Which are Common Reasons for Car Insurance Claims Denials in Owensboro, Kentucky?

Car insurance companies in Owensboro deny claims for different reasons, sometimes legitimate, other times not. Here are some of the most common reasons for auto insurance claim denials.

The Insurance Provider Claims You Could Have Avoided the Accident

The insurance company might claim that you contributed to the accident. For instance, they could claim that you were driving while intoxicated or distracted. Sometimes, these companies make such claims without evidence or conducting thorough investigations. And after religiously paying your insurance premiums, the last thing you want is to be denied insurance benefits because of hearsay and not facts.

You Did Not Seek Immediate Medical Attention After the Accident

The insurance provider will not settle medical expenses if you do not seek medical attention after the accident. This explains why it's always advisable to seek immediate medical attention after the accident, even if you initially do not feel any pain or discomfort. After a car accident, some injuries take days, weeks, or even months to show.

For instance, whiplash isn't something you'll feel seconds after the accident. Instead, you'll begin experiencing whiplash symptoms a few days, weeks, or even months after the accident. Unfortunately, by the time you begin to experience these symptoms, it may be too late to pursue a claim with your insurance company to settle your medical expenses. Typically, you have up to 14 days to seek medical attention after a car accident. However, the sooner, the better.

This is because even if you have a few days to seek medical attention, the insurance provider could use this window to find any excuse to deny your claim. For example, they could claim that you got injured elsewhere, effectively releasing themselves from liability.

In some cases, they might even want to settle only part of your claim and blame you for the rest. Again, this is simply because there was a huge gap between when the accident occurred and when you sought medical attention. Although you may be able to explain this gap, insurance companies are relentless in finding loopholes to dismiss or minimize a claim. In fact, that's one of the many ways these companies make money.

You Filed Your Claim Late

When is it too late to file a claim? This is one common question many car insurance policyholders ask themselves, especially after getting into an accident. The truth is that the deadline varies depending on several factors, including but not limited to the terms of the insurance contract.

Most insurance policies require policyholders to file a claim within a year of the accident. However, insurance laws have many technicalities that you'll need to navigate. So when the insurance company denies your claim because it is supposedly time-barred, you may need to speak with an attorney.

The attorney will review the terms of the insurance and then help determine whether or not your claim is time-barred. And if indeed the claim has expired, the attorney will advise you on how to proceed with the case.

What are Common Bath Faith Insurance Practices to Watch Out For?

As mentioned before, insurance companies are in business like other businesses in Owensboro. They make most of their profits from the premiums their clients pay and also by limiting the amount of money they pay out to their clients when they file a claim. This explains why such companies never let anything slide, especially if it allows them to save an extra dollar. Whenever they find a loophole to dismiss or deny your claim, they'll make good use of it.

But then there's another reason a car insurance company might deny your claim - bad faith insurance practices.

What Are Bad Faith Insurance Practices?

When you sign an insurance contract, you expect the insurance provider to act in good faith. More specifically, you expect them to process your claim and provide you with the benefits you're entitled to after an accident. However, some insurance companies act in bad faith, meaning they'll still deny your claim even if they know they shouldn't do so.

Here are some common examples of bad faith insurance practices you need to know:

Refusal to Pay

Some insurance companies will simply refuse to process your claim. They'll try to come up with a reason for denying your claim, and half of the time, the excuse is never valid. If you believe that your insurance provider acted in bad faith when they denied your claim, a car insurance lawyer in Owensboro, KY, can help hold them accountable for their actions.Conducting Poor Investigations (or No Investigations at All)

We mentioned earlier that some insurance companies might deny your claim without facts. Sometimes, they might even deny your claim due to gossip. Some will blame you for an accident when deep inside, they know they didn't investigate the accident as they should.When the insurer fails to conduct proper investigations, consequently denying a claim, the policyholder might not know what to do next. In fact, some policyholders end up believing that they are responsible for the accident. But that is not always true. Rogue insurance providers can frustrate and manipulate you. When you find yourself in such a situation, you should speak with an attorney.

Failure to Respond to a Claim

When you file a claim with an insurance company in Owensboro or elsewhere in Kentucky, they have up to 15 days to acknowledge the claim. If you don't hear back from them for more than 15 days, you may consider speaking with an attorney. This could be one of the many tactics insurance providers use to avoid compensating car accident victims.In addition, insurance providers in Kentucky have up to 45 days to settle a claim. You may be able to take legal action against them if they fail to settle the claim within 45 days after approval.

How Can Morgan & Morgan Car Insurance Attorneys in Owensboro Help?

The kind of law firm or attorney you hire to represent you can significantly influence your case. When looking for an auto insurance lawyer in Owensboro and its surroundings, it's important that you work with only the best. Here's why Morgan & Morgan stands above the competition:

We are the largest personal injury law firm in the United States. This alone is enough to notify the insurer that they need to get their act together.

To prevent insurance companies from denying your claim, it is important to conduct thorough investigations to prove your case. But these investigations are expensive and time-consuming, which is why you need a law firm with powerful resources. Our law firm has unlimited legal resources to fight for you.

Morgan & Morgan has a solid reputation for taking down even the mightiest bullies in the insurance industry. And we have a track record to prove that. For over three decades, we've served clients all over the country and helped them recover more than $30 billion as compensation from insurance companies.

Choose the Right Injury Law Firm, Get the Best Legal Representation

Morgan & Morgan car insurance attorneys are available 24 hours a day, 7 days a week, to fight for you. Call our Owensboro office at 270-938-6900 for a free consultation or fill out our free case evaluation form, and one of our legal representatives will get in touch with you.

Our Results

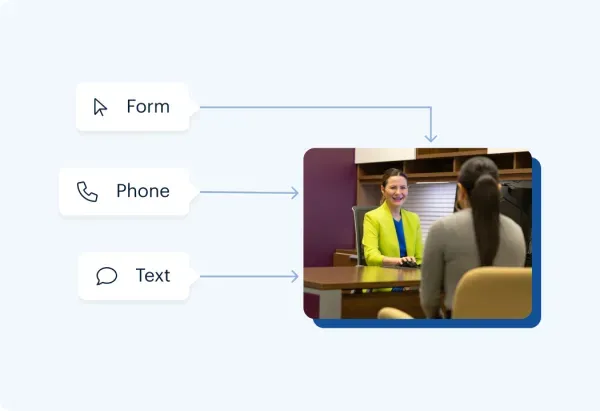

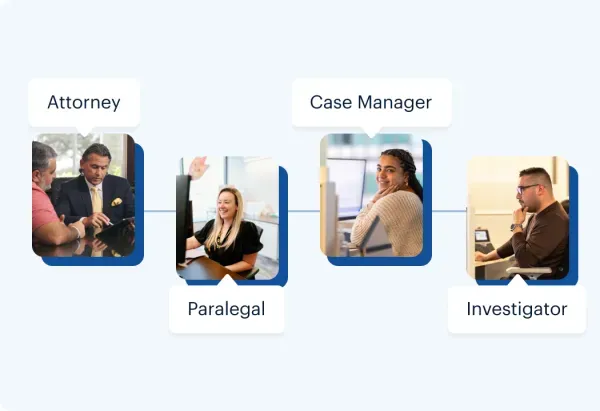

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.