Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

WHAT IS THE LAW REGARDING DECEASED DEBT IN FLORIDA?

We help people unite to take on and hold corporations accountable.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

What Is the Law Regarding Deceased Debt in Florida?

In the state of Florida, many people are uncertain about the laws regarding debt. For instance, many residents are unsure about the details of Florida law on deceased debt.

What happens to your standing debt in the event of your death? What do you do if a family member dies and leaves behind debt? There is no universal answer to these questions in Florida, but we can offer some helpful information.

Below, we will examine some of the most important issues related to Florida law on deceased debt. When you have questions regarding debt, it is critical to consult with a skilled legal professional.

If you need guidance through the process of planning your estate, speak with an estate planning lawyer in Florida. A knowledgeable attorney will have a thorough understanding of Florida law on deceased debt and other estate planning issues.

When you reach out to the legal team at Morgan & Morgan, we will examine the facts of your case thoroughly. Our legal team will help you determine the best course of action to protect your assets and interests.

Do not settle for less than the best legal representation. For a no-cost and no-obligation legal evaluation, complete the easy-to-use contact form on our firm’s website.

Florida Law on Deceased Debt: An Overview

In most cases, the debts of deceased Florida residents are not passed to the surviving family members. Florida state law does not permit the transfer of debts in this way.

However, it is legally permissible for debts to be paid with the decedent’s estate before the family receives it. Additionally, certain types of property-related debt might pass to the heirs.

For instance, suppose that someone owns a piece of property with a lien on it. If the property owner passes away, their next of kin may become responsible for the lien after inheriting the property in question.

In a case like this, the benefactor will choose whether they will accept the inheritance. Accepting the property will usually mean taking responsibility for the related debt.

To determine whether your debt will be passed to your heirs in the event of your death, speak with an attorney. A qualified Florida estate planning lawyer will review your financial situation to determine the best path forward.

Understanding Debt Inheritance in Florida

There are certain steps to make distributing inheritance easier in Florida. For example, writing a will or establishing a trust can help make financial processes simpler.

If no will has been written, Florida adheres to the Intestate Succession Law. This is also the case when the decedent’s will is considered invalid.

The Intestate Succession Law allows the legislature in Florida to determine the outcome of the estate. The legislature can decide how to distribute the estate in probate. In these cases, precedence goes to:

- The surviving spouse

- The decedent’s children

- The decedent’s parents

Still, any outstanding debt will be taken from the estate. This means that debt holders have the legal right to pursue payment from the deceased individual’s bank accounts, savings, and other assets.

The remainder will be distributed to the benefactors as the legislature sees fit. However, some unique circumstances may leave surviving family members responsible for the decedent’s debt.

If you believe you may be responsible for the outstanding debt of a loved one, make sure to contact an attorney who understands Florida law on deceased debt.

The team at the firm of Morgan & Morgan has plenty of experience in these cases. You should not be held responsible for a loved one’s debt in most instances. Our compassionate lawyers will review your circumstances and help you determine how to proceed.

Cases in Which You May Be Responsible for Deceased Debt

In most cases, relatives cannot be held accountable for the debt held by their deceased loved ones. This is due to the Deceased Estate Law in the state of Florida.

However, heirs may be held responsible for debt in some circumstances. Some of the situations in which this is the case include:

The Surviving Family Member Signed an Obligation

If you opened a joint account or line of credit with the decedent, you might be responsible for the associated debt. Those who sign on as account holders can be held liable for any debt accrued.

For instance, suppose that you signed onto your father’s line of credit as an account holder. If your father passes away, you can be required to pay off the debt associated with that account.

This is not true if you are only categorized as an “authorized user.” Only account holders can be held liable for paying off debt in these situations.

You Violated Relevant Probate Laws

Suppose that you are the person in charge of handling your deceased relative’s estate. In this case, you will be required to pay off any of the decedent’s debts using the assets from the estate.

In some instances, you may need to sell the items they owned to pay the money that was owed. Failing to pay the decedent’s creditors is an illegal action.

Similarly, preventing creditors from securing payment through the wrongful use of the decedent’s assets is prohibited. If you have taken these actions, you could be required to pay back the decedent’s debt with your own money.

Your Spouse Passed Away

If your spouse has died, you could be held accountable for some of their remaining debt. Florida’s statutes and rules surrounding the transference of debt in these circumstances are complex.

If you have entered into any loans with your spouse before their death, you will be responsible. In some cases, the debt holder may be permitted to contact you regarding the deceased individual’s account.

When you are dealing with any dispute involving a deceased family member’s debt, reach out to a legal expert to secure a positive outcome in your case. The trustworthy legal team at Morgan & Morgan will help you resolve disputes and secure your future estate.

Do not allow greedy debt collectors to pursue money that you do not owe. Contact a knowledgeable attorney to explore all of your rights and options.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Our Results

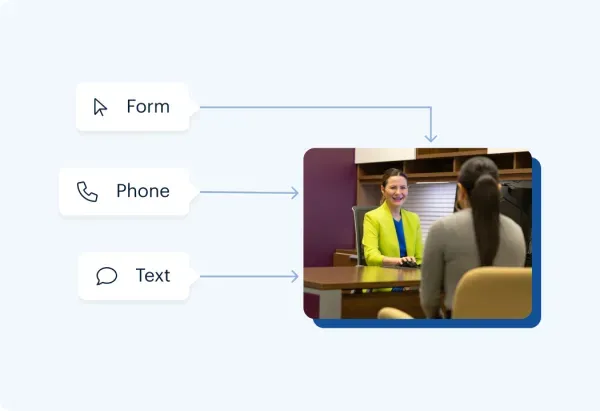

How It Works

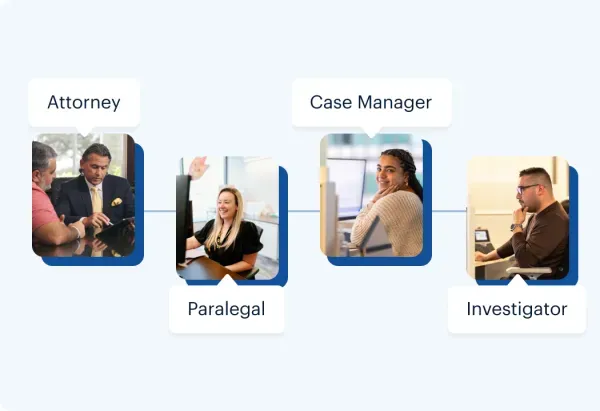

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

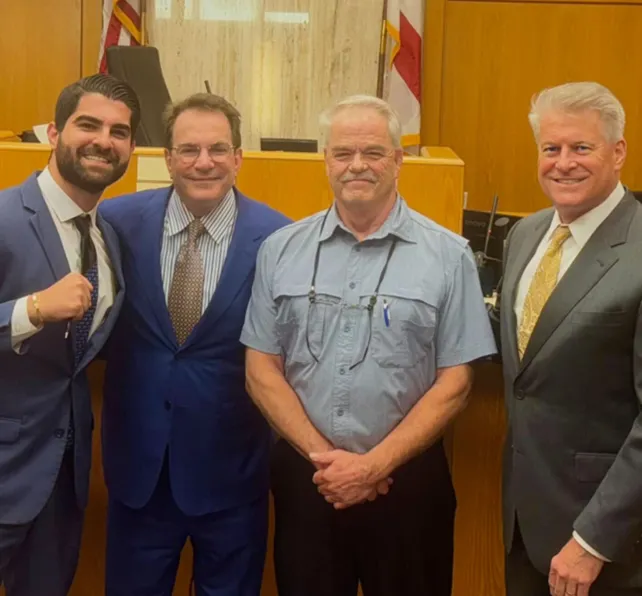

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

In the Community

Discover the local Morgan & Morgan experience with news, events, and partnerships.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.

Can Debt Collectors Contact Survivors Regarding Debt?

In some cases, creditors are legally permitted to contact the survivors of the debtor. For example, a creditor is permitted to contact the decedent’s spouse when seeking contact information for the estate holder.

Even in these cases, the debt holder is not permitted to claim that the spouse is responsible for paying the money back. This is true as long as the spouse is not a joint account holder or cosigner on a loan.

If you are the legal executor of the decedent’s estate, creditors are legally allowed to contact you about the deceased person’s outstanding debt. You will be responsible for ensuring that the decedent’s assets are used to settle their accounts before being distributed to benefactors.

Can My Deceased Spouse’s Debt Affect My Credit Score?

In most cases, no. Aside from the exceptions discussed above, credit holding companies are not permitted to report your deceased spouse’s debt to credit reporting agencies to represent your financial status.

If a debt holding company does this, you should contact the credit reporting agency to dispute the claim. With the help of a skilled attorney, you can effectively protect your credit score.

Make sure to speak with an attorney with extensive legal experience. You should contact a lawyer or firm with knowledge of the following:

- Debt collection defenses

- Estate and probate matters

- The Fair Debt Collection Practices Act

- Consumer law

- Florida law on deceased debt

A knowledgeable legal professional will review your case and help you protect your credit score and assets.

How Are the Attorneys at Morgan & Morgan Compensated?

Like all reputable tort law firms, Morgan & Morgan operates on a contingency fee payment approach. With this approach, clients do not pay anything unless their attorney successfully wins or settles the case.

When you hire one of the legal professionals at Morgan & Morgan, we will agree to a specific portion of the recovery from your deceased debt case. After we win or settle your claim, that percentage will be used to cover our costs and fees.

You should never hire a lawyer or firm that requires payment before agreeing to represent you. The compassionate lawyers at Morgan & Morgan believe that everyone deserves to pursue justice, not only those with spare financial resources.

With Morgan & Morgan, you will not pay a single penny unless we recover the money that you are rightfully due.

What Should I Know About a Lawyer Before Hiring Them?

Most trustworthy tort attorneys will provide new clients with a free consultation to review the facts of a potential case. During this initial meeting, it is critical to ask any questions that you have.

You can inquire about the general legal process and the specifics of your case. Some typical questions that new clients ask include:

- How long have you been practicing law?

- Have you handled deceased debt cases before?

- What is your case success rate?

- How does your firm handle attorneys’ fees?

- Do you believe I have a valid claim?

- What would your negotiation strategy be in my case?

- How long do you believe this claim would take?

These are only a few examples of the questions that new legal clients ask. Make sure to bring notes about the specifics of your case.

The more information you can provide to your lawyer, the better. You should think of the initial consultation as an opportunity to determine whether the particular attorney or firm is right for you.

Let Morgan & Morgan Recover the Money You Deserve

When you need legal representation in a deceased debt case, look no further than America’s largest tort law firm: Morgan & Morgan. Our skilled legal team understands what is necessary to protect our clients’ assets and interests.

Since the founding of our firm, our team has successfully helped over 100,000 clients. As a result, we have secured more than ten billion dollars in financial recovery for our clients.

Do not settle for less than the best legal team. Fill out the contact form on the Morgan & Morgan website to schedule a no-cost and no-obligation case evaluation today.