Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Overtime Attorneys in Mississippi

If your employer denied you overtime pay, we fight to recover your lost wages and ensure fair compensation for your work.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Mississippi Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

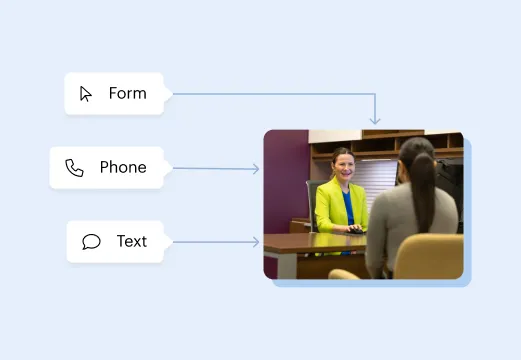

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

What to Know About Mississippi's Overtime Laws

Like many other states, Mississippi requires payment of overtime wages for those hours worked beyond 40 in a given work week. The federal pay policy establishes that the premium overtime rate is to be 1.5 times the employee's regular hourly wages and both voluntary and mandatory overtime hours count towards paid time. However, overtime laws do not protect every employee in Mississippi.

There are many different employees who are exempted from coverage and overtime laws. Overtime exemption is primarily based on the employee's salary and job duties. The most common types of exempt workers include taxicab drivers, outside salespersons, salaried employees earning $684 or more each week, fishermen, employees of recreational establishments, computer professionals who make over $27.63 an hour, professional employees such as lawyers and teachers, and employees with administrative or executive positions earning at least $684 per week. This does not include every type of exempted employee under Mississippi's overtime laws, so it is important to do your own research before you contact an attorney about your legal case.

One of the best things you can do is to keep track of all of your pay slips and working hours. You may be shocked at how much those overtime hours can really add up. You may ultimately need to provide that evidence to your overtime wages lawyer in MS, so this will also help you make your case and truly fight for the maximum compensation.

Your lawyer will answer your biggest questions about filing for overtime wages and some of the common misconceptions about getting your damages back. If you can bring any evidence to your lawyer's office for your first consultation, you'll be able to make more informed decisions about whether or not you want to initiate an overtime lawsuit in MS.

Recognizing Minimum Wage Laws

Those employees who are protected by the Federal Fair Labor Standards Act are entitled to receive at least $7.25 per hour as a minimum wage. For hours at work that exceed 40 hours in a work week for non-exempt employees, overtime rates cannot be any less than 1.5 times regular pay. Misclassification of employees is a common legal issue that emerges in these Mississippi overtime pay lawsuits. Misclassification can be accidental or deliberate, but the primary purpose of a court in evaluating these circumstances is whether or not the employee has been shortchanged.

Many employees who earn salaries assume they are not entitled to overtime; however, mandatory overtime may apply to multiple salaried employees including retail workers, managers and more. Even those people who work for piece rates could be entitled to overtime under federal and state wage and hour laws. If you believe that your employer has blocked you from getting the pay that you are owed, you need to consult with a qualified attorney to help you.

You may be under the impression that you're not able to get overtime because you're an exempted employee. It's very important that you know the specifics of your job and situations in which you might be entitled to actual overtime payments. Do not trust that your employer is automatically right about your classification as a worker who does not have to comply with these rules. Do your own research to determine what applies to your case and your individual job.

Statute of Limitations for Overtime Claims

You have a limited period of time in which to file a claim for overtime payments. This is in line with the Fair Labor Standards Act which requires those who are seeking unpaid back overtime wages to initiate their lawsuit no later than two years after the date of the employer's wage violation. This means that lawsuits filed now would only stretch back recovery for back overtime for the previous two or possibly even three years. If an employer's violation of the Fair Labor Standards Act, however, was willful, the statute of limitations could be extended to the three year period.

Make sure that you speak to a lawyer as soon as you can so that you can determine when it's in your best interests to talk to an attorney about your options. While you don't need to file an overtime claim immediately, you also don't want too much time to go on because you might miss out on the statute of limitations and your right to file.

What Should I Do if I Believe I Have an Overtime Claim?

If you have an unpaid overtime claim, it is in your best interests to get legal counsel as soon as possible. A lawyer who understands the various aspects of unpaid overtime laws and backpay owed to you will be able to evaluate your individual case and provide you with further clarity on what to do to protect yourself. Although it can be challenging to bring up these claims, especially if you're still working for the employer in question, you need to have the right attorney to review your case and provide you with valuable insight on your claim. Your attorney can also tell you whether or not you are still within the time period for the statute of limitations.

There are many different overtime law components in Mississippi. The overtime provision of the Fair Labor Standards Act is the core but Mississippi code 21-8-21 covers police officers and firefighters as well. There is a specific wage complaint filing process, and this includes initiating a wage complaint form with the Mississippi Department of Labor or filing a complaint to the U.S. Department of Labor. There are exemptions for firefighters and police officers because of the state overtime laws that apply in Mississippi. Police officers and firefighters can be paid by the state for any work required of them outside of their normal hours. One of the most complicated aspects of these statutes is that the phrase “normal hours” is not defined. However, bear in mind that these employees are prohibited from working on jobs unrelated to their main job during normal working hours.

Does Holiday Pay Count?

Some employees may also be eligible for holiday pay if they are not paid for time typically worked on official holidays. Multiple employers provide this benefit throughout Mississippi to their employees and this pay does not count as overtime pay either. This means that those employees compensated for holiday pay do not earn that pay at the overtime rate, even if it extends beyond 40 hours in a single work week. Certain employers, however, will offer to pay more during these holiday hours. If you believe you have been denied overtime, you may begin calculating your possible losses in preparation for a discussion with an overtime attorney. You may need to file a lawsuit sooner rather than later to protect your legal rights and to ensure you don't exceed the statute of limitations.

Why Hire Morgan & Morgan For An Overtime Wage Claim?

The right overtime attorneys in Mississippi can help you with your wage claim in that state. The lawyers at Morgan & Morgan recognize the many challenges associated with filing an overtime wage claim and will be able to sit down with you at the outset of your case to discuss the specifics. Having this counsel before deciding to move forward with a lawsuit or a formal wage complaint can be extremely beneficial for giving you clarity on what to expect. If you're concerned about being able to recover fair compensation, you may need an attorney in your corner to advocate for you from day one. If you have questions about this process, make sure that you consult with an attorney who understands the many aspects of an overtime wage claim.

Contact us today for a free, no-obligation case evaluation to learn more.