By Appointment Only. Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel.

Car Insurance Claims in Illinois

Car crashes can derail your life. We've helped thousands of people recover—physically, financially, and emotionally—after an accident.

By Appointment Only. Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel.

Illinois Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

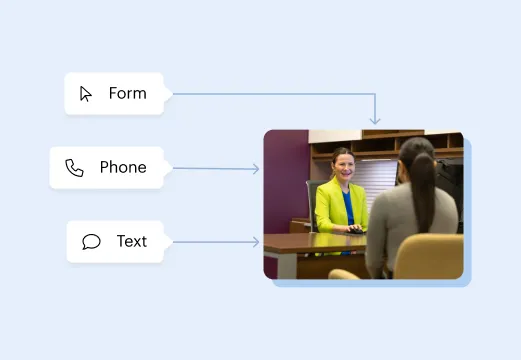

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

How Can Morgan and Morgan Help?

If an insurance company dismisses or devalues your claim, Morgan and Morgan car insurance attorneys might be able to help. While there are many auto insurance lawyers in Illinois, Morgan and Morgan stand out when it comes to fighting for the rights of individuals injured due to someone else's negligence.

Here is what makes us different:

Experienced Car Accident Insurance Attorneys

Morgan and Morgan boast years of experience when it comes to fighting for the rights of individuals who have been injured in car accidents. For this reason, we know the different tactics insurance companies use to deny their accident victims the compensation they need and deserve. When you contact us for a free case evaluation, we will determine whether you have a valid case against the insurer.

If your case is valid, we will review the insurance provider's actions. And if we suspect any wrongdoing, such as a blatant denial of a valid claim, we will help fight for you, ensuring you receive the compensation you need.

We Have the Resources to Fight for You

Insurance companies make millions of dollars every year in profits. Therefore, they can easily afford some of the best defense attorneys in Illinois. This explains why you need to work with an attorney with powerful legal resources to overpower the other party's legal muscles.

At Morgan, we are the largest personal injury law firm in Illinois and throughout the country. In addition, we have the legal resources to fight for you. We are not just one of those law firms that agree to settle for anything just to end the case. Rather, we believe in fighting for what our clients truly deserve. If the offer does not reflect what our clients deserve as compensation for their injuries, we will simply not accept it.

That is because we have powerful legal resources to fight. Law firms or solo attorneys that settle for just any settlement amount do not usually have the resources to fight, and that is why they would rather settle for a lowball offer. At Morgan and Morgan, we have the resources needed to take on some of the biggest names in the insurance industry.

We Have a Proven Track Record

If a law firm's track record is anything to go by, then you can rest assured that you are in the right team when you choose to work with us. This is because Morgan and Morgan has a solid track record of winning these kinds of cases.

To put things into perspective, as of August 2022, we have helped our clients recover more than $25 billion as compensation for different kinds of injuries, including car accidents. This tells you one thing; we are not the kind of law firm that is all talk without action. Instead, we back our words with facts. Our results prove that we know what we are talking about.

Where Do I File a Claim If I Got Injured in a Car Accident in Illinois?

If you got injured in a car accident in Illinois caused by the other driver, you could file a claim with their insurance company. Illinois is an at-fault state when it comes to car accidents, meaning the other driver's insurance provider is responsible for compensating the accident victim.

Contact Morgan and Morgan car insurance attorneys for a free case evaluation if you have suffered significant injuries. We may be able to recover more.

How Long Do I Have to File a Claim After a Car Accident in Illinois?

In Illinois, the statute of limitations for car accidents is two years from the date of the accident. Since you have a tight deadline to beat, it is advisable to contact an attorney as soon as possible if you or your loved one has suffered significant injuries. An experienced attorney will help you beat deadlines you didn't know existed.

How Much Money Do I Need to Hire a Morgan and Morgan Car Insurance Attorney in Illinois?

Zero. Morgan and Morgan charge their clients on a contingency basis. This means they only get paid if they win the case. If they lose, they do not get paid. So if you or your loved one has a dispute with the other party's insurer, we will help you without any down payment.

How Long Does the Insurance Company Have to Settle My Claim?

In Illinois, insurance companies have up to 45 days to settle a claim. Similarly, they have up to 15 days to respond to the claim. If the insurer does not respond within 15 days, contact a Morgan and Morgan car insurance attorney immediately. They might be able to help.

How Can I Contact Morgan and Morgan Car Insurance Attorney in Illinois?

To contact a Morgan and Morgan car insurance lawyer in Illinois, fill out our free case evaluation form. Alternatively, call our Illinois office at 312-706-0550 to speak with one of our representatives about your injuries.