Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel. Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state, please visit our attorney page.

Hurricane Insurance Claims in Hawaii

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel. Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state, please visit our attorney page.

Hawaii Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

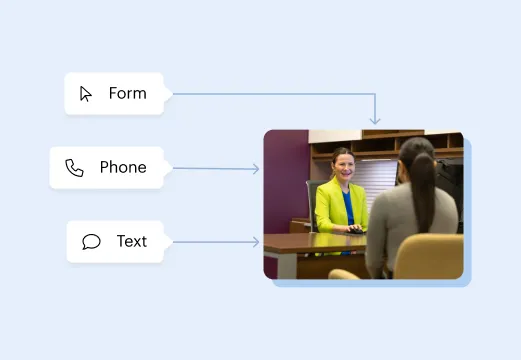

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

Why You Need a Lawyer

There’s virtually no limit to the destruction a hurricane can cause:

- Broken windows and doors

- Flooding

- Structural damage

- Fire damage from downed wires

- Vehicle damage

- Mildew and mold growth

- Dislodged siding and roofing

- Damage to appliances

- Exterior damage due to fallen branches

The list goes on. Unfortunately, the insurance company might not willingly pay these damages. Instead, they might:

- Deny or undervalue your claim

- Neglect to make payments

- Falsely assert that certain damages are not covered under your policy

- Delay processing your claim

- Require that you sign a release of supplemental claims

If you encounter difficulties with your insurance company after a hurricane or tropical storm, contact our Hawaii attorneys. Our legal team can evaluate your claim to identify its actual value, then pursue full compensation on your behalf.

Protecting Your Claim

If you sustain property damage, be sure to take these measures to protect your claim.

- Keep records: Take photographs of all the damage to your home, both inside and out. Keep a list of everything you see.

- Protect against further losses: Check the “Duties After Loss” section in your policy to see exactly what’s expected of you in terms of reducing further damage. You might, for example, need to cover your property with tarp if you can safely do so.

- File your claim quickly: Your policy likely requires that you file a claim within a specific period of time.

Contact Morgan & Morgan

If you’ve had trouble recouping your losses following a hurricane in Hawaii, contact Morgan & Morgan. Our attorneys can handle the insurance company while you focus on getting your life back on track.

There’s no risk to you: It costs nothing to hire us, and we get paid only if we successfully resolve your claim. Contact us for a free, no-obligation case review today.