By Appointment Only. Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel.

How to Appeal a Car Insurance Claim Decision in Burlington, Vermont

Car crashes can derail your life. We've helped thousands of people recover—physically, financially, and emotionally—after an accident.

By Appointment Only. Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel.

Vermont Personal Injury Lawyers

We’re proud to fight for our neighbors. Meet the attorneys from your community.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Based on select nationwide reviews.

Results may vary depending on your particular facts and legal circumstances.

Our Results

Results may vary depending on your particular facts and legal circumstances.

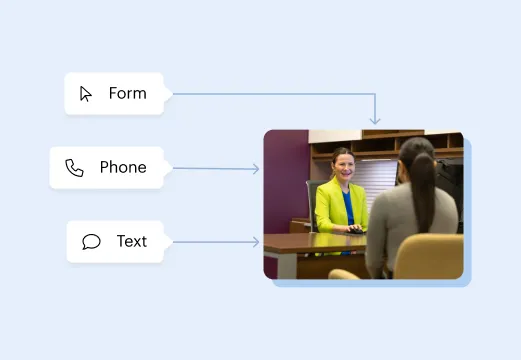

How It Works

Focus on your recovery. We'll take care of the rest.

Submit your free evaluation

Start your claim

Meet your legal team

We fight for more

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$25 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next? We'll guide you through everything you need to know.

Get answers to commonly asked questions about our legal services and learn how we may assist you with your case.

How Do I Know Whether the Other Driver Is Liable for My Damages?

If another driver acted negligently or recklessly in causing your accident, they are generally liable for your damages in Burlington. All drivers have a duty of care towards other road users. Dangerous driving and violating road laws breach this duty of care. According to the National Highway Traffic Safety Administration (NHTSA), risky driving behaviors include but are not limited to:

- Driving under the influence of alcohol or drugs

- Speeding

- Distracted driving

- Drowsy driving

If you were involved in an accident with a negligent driver and they are at fault for the crash, their insurance company should reimburse you for damages. Morgan & Morgan understands how difficult it can be for some victims to get what they deserve and need to rebuild their lives after suffering an injury. Our car accident lawyers can assess your claim, determine liability, and appeal a car insurance claim decision in Burlington.

Which Damages Could I Receive With a Car Insurance Claim of Lawsuit?

If another caused your accident, injuries, and damages, you could be entitled to a comprehensive insurance settlement, including the following:

Medical Expenses

If you were injured in an accident in Vermont, a settlement should reimburse you for all medical costs, including future estimated expenses. You could receive awards for:

- Hospitalizations

- Surgeries

- Rehabilitation therapies

- Medical devices

- Transportation

- Specialist appointments

- Diagnostic tests

- A home health aide

Loss of Wages

If you were severely injured, you might be off work for some time during recovery. Those suffering catastrophic or disabling injuries may never be able to return to their career and make a living. Therefore, victims may be entitled to a settlement amount for loss of wages and loss of future earning capacity.

Pain and Suffering

Accidents do not only cause physical injuries but can also lead to great suffering and anguish. Individuals may suffer from chronic pain, emotional trauma, and other consequences. Injured car accident victims could qualify for the following so-called “non-economic” damages and others:

- Pain and suffering

- Emotional distress

- Disability

- Loss of a limb or a sense

- Disfigurement and scarring

- Reduced quality of life

If you suffered a significant injury, you could be entitled to a comprehensive settlement for your monetary damages and suffering. Our experienced insurance attorneys can fight tirelessly for what you deserve when an insurer denies fair compensation.

What Can I Do to Maximize an Insurance Settlement?

There are some crucial steps you can take after the accident that can help protect your legal rights to a fair settlement, including:

- Staying at the accident scene until law enforcement arrives

- Taking photographs of the crash scene and vehicles

- Calling 911 for medical help if anyone is injured

- Gathering insurance and contact information from other parties

- Collecting eyewitness contact information

- Seeing a doctor and getting a medical report detailing your injuries

- Contacting a car accident lawyer for help and advice

However, it is crucial to know what could reduce your chances of receiving a settlement. Leaving the scene of a car accident, for whatever reason, can qualify as a “hit and run” under the law and could be damaging to your claim. Although emotions can run high in car accidents, refrain from apologizing or arguing with other drivers.

Moreover, you should not speak about your accident and insurance claim with anyone other than your attorney and avoid posting any details on social media channels. The insurance company will look for reasons to minimize or deny your claim. If you are seeking damages such as pain and suffering or income losses and post pictures on vacation or playing sports, you may have trouble recovering what you deserve.

Can I File a Lawsuit Against the Insurance Company?

If an insurer keeps denying or minimizing your claim, you may be able to take them to court and recover damages. You could have a legal case if the insurer:

- Failed to investigate your claim or significantly delayed investigating your claim

- Refuses to pay a settlement despite liability being clear

- Fails to issue your payout within a reasonable time

- Denies a claim without explaining why

If you cannot get what you deserve after a car accident, consult with an attorney as soon as possible to clarify your options. Morgan & Morgan’s dedicated car accident lawyers can help you file a lawsuit to get what you deserve.

Can I Recover Compensation if I Have Some Fault for the Crash?

Car accidents can be complicated. It is not unusual for several parties to share responsibility for a crash. While this can complicate your recovery, having some fault does not necessarily bar you from pursuing compensation. The state of Vermont follows an amended doctrine of comparative negligence, which means that anyone hurt in a collision could seek damages, providing they are no more than 50 percent responsible for the crash.

However, your percentage of fault will reduce the amount you can claim from an insurer. For example, if you are 40 percent responsible for causing the accident, you can generally only recover 60 percent of your losses. Cases, where the fault is shared, can be tricky to resolve. Consider hiring a lawyer to protect your rights and ensure the insurance company does not assign you an unfairly high degree of fault.

Is It Worth Hiring an Attorney to Fight the Insurance Company?

Results of a lawsuit are never guaranteed. However, when we take your case, you do not have to pay anything unless we win and recover a settlement for you. In most car accidents with injuries, getting legal advice and hiring an attorney can be beneficial, particularly if an insurance company refuses to pay you. Going it alone could mean you are up against an insurance company with unlimited resources and lawyers who fight claims like yours every day.

If you suffered significant injuries or liability for the accident is unclear, hiring a skilled attorney can be critical for your case. Morgan & Morgan’s experienced car accident lawyers can take the burden off your shoulders and appeal a car insurance claim decision in Burlington. We never settle for less because we know that victims need a settlement to pay for their bills and move forward. If an insurer is dragging its heels, we can take them to court to fight for your right to adequate compensation.

Morgan & Morgan Is on Your Side

If you got hurt in a car accident, Morgan & Morgan is here to fight for what you deserve. As America’s largest personal injury firm, we have helped thousands of injured individuals and recovered over $25 billion in damages. Don’t let an insurance company get away with underpaying or denying your claim in Burlington. Contact us now for a free consultation to find out how we can help.