Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

PORT ST. LUCIE INSURANCE ATTORNEY

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Insurance Lawyer in Port St. Lucie

You should be able to count on your insurance company when filing a valid claim. Unfortunately, some insurers will try anything to get out of their obligations when policyholders experience losses, leaving them to struggle financially. Morgan & Morgan thinks this is unethical and plain wrong.

If you were involved in an accident, suffered an injury, or had another covered loss, you shouldn’t have to battle to receive your due. An insurance lawyer in Port St. Lucie can help you navigate the legal aspect of your insurance claim and hold an unscrupulous insurer accountable.

Remember that you’re not powerless if an insurer unfairly delays, minimizes, or denies your legitimate claim. Morgan & Morgan is here to help you fight back. Contact us today for a free consultation to find out more.

What Does a Port St. Lucie Insurance Lawyer Do?

An insurance lawyer at Morgan & Morgan represents individuals or businesses in insurance claims. They have extensive knowledge of insurance policies, coverage, and regulations. If you cannot receive adequate payment for a valid insurance claim, our insurance lawyers in Port St. Lucie can protect your rights, negotiate with the insurance company, and file a lawsuit if necessary.

How A Morgan & Morgan Insurance Lawyer Can Help

Rather than helping policyholders move forward after a loss, some insurance companies are more focused on their profits, leaving customers frustrated and out of pocket. However, if you have paid your insurance premiums faithfully and have a legitimate claim, the insurer must uphold their part of the deal. An attorney can “remind” your insurance company about its responsibilities and obligations.

If you’re having trouble getting what you deserve from an insurance company, our Port St. Lucie insurance lawyers can help you in several ways:

Protect Your Rights

Insurers may try to use manipulative tactics to reduce or deny your valid claim. They may try to take advantage of individuals unfamiliar with insurance law or vulnerable after a serious accident or injury. An insurance lawyer can protect your rights and ensure you are treated fairly and with the respect you deserve.

Review and Evaluate Your Insurance Policy

Insurers sometimes refuse legitimate claims, citing policy exclusions and limits. Our attorneys can review your insurance policy thoroughly to determine your coverage and the benefits to which you are entitled. They can help you understand the policy’s fine print, exclusions, and limitations. If an insurer wrongly states that your policy does not cover your claim, we can fight for what you deserve.

Investigate Your Claim

An insurance lawyer can thoroughly investigate your accident, injury, or homeowner’s loss to gather evidence and build a strong case on your behalf. They can work with industry experts, such as accident reconstruction professionals and medical providers, to strengthen your case.

Negotiate With Insurance Companies

Insurance companies are in the business of making money, and they will often try to settle claims for the lowest possible amount. However, this can leave a policyholder high and dry after a considerable loss, such as a life-changing car accident injury or significant storm damage to their house. An insurance lawyer can level the playing field, advocate for you, and negotiate with insurance companies for a fair settlement that covers your expenses.

File a Lawsuit

If all else fails and an insurance company keeps dragging its heels, Morgan & Morgan’s insurance lawyers in Port St. Lucie can file a lawsuit and take the insurance company to court. Our insurance attorneys are experienced trial litigators who know how to prepare and present evidence, argue your case powerfully, and fight hard for maximum compensation.

Types of Claims Insurance Lawyers in Port St. Lucie Handle

Insurance attorneys can help you fight back against immoral insurance companies that want to refuse you the settlement you deserve for a covered loss. Morgan & Morgan’s insurance attorneys can handle a variety of claims, including but not limited to:

- Car insurance

- Homeowners’ insurance

- Health insurance

- Disability insurance

- Life insurance

- Professional liability insurance

- Business interruption insurance

Florida residents pay dearly for insurance coverage. According to the Insurance Information Institute (III), homeowners insurance averaged more than $4,000 in 2022, almost triple the country’s average annual insurance cost. Florida drivers don’t fare any better. Bankrate says that vehicle owners in the state pay over $1,000 more for insurance than drivers elsewhere in the country.

When you pay a premium for coverage, you deserve to get paid promptly in the event of a covered loss. An insurance attorney at Morgan & Morgan can stand up to the insurer on your behalf.

Bad Faith Insurance Claims

Insurance companies must act in good faith when handling claims, meaning they should investigate claims promptly, fairly, and thoroughly. Moreover, insurers are also obligated to pay out valid claims in a timely manner.

Some insurance companies engage in bad faith practices, such as denying legitimate claims unfairly, delaying payment, or offering an unreasonably low settlement amount. If your insurance company acted in bad faith, Morgan & Morgan’s insurance lawyer in Port St. Lucie could help you file a bad-faith insurance claim and receive compensation in addition to your claim’s value.

You Could Recover Damages From an Unethical Port St. Lucie Insurer

If you win a lawsuit against an insurance company, you could receive the value of your original claim. Moreover, if the insurance company acted in bad faith, you could be entitled to damages above and beyond your claim amount, including awards for:

- Financial damages due to the unfair claim denial

- Emotional distress

- Humiliation

- Loss of reputation

- Attorney’s fees

You could also recover punitive damages if your insurer egregiously or maliciously denied you a fair settlement.

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Our Results

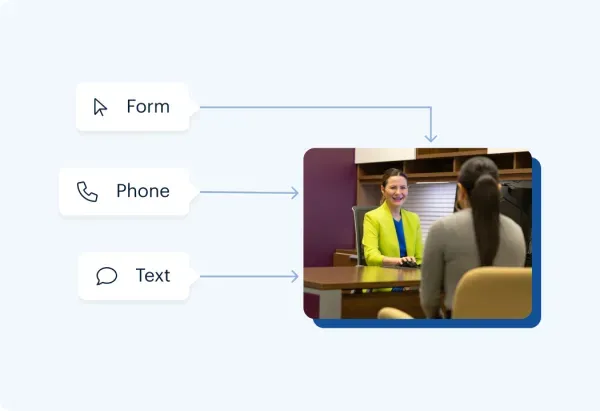

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.

What Are My Next Best Steps After a Covered Loss?

If you need to file a claim with an insurance company, protect your rights and increase your chances of receiving a fair settlement by taking a few simple steps, including:

- Review your insurance policy: Check your insurance policy meticulously to determine your coverage and the next best steps. Pay attention to any deadlines or requirements for submitting a claim.

- Document your losses: Take photos or videos of the damage and gather any physical evidence, such as damaged property or medical bills.

- Contact your insurance company promptly: Report the loss to your insurer immediately. Provide all the required information and cooperate fully, but avoid admitting fault or making statements that could be misconstrued as admitting responsibility.

- Keep track of all correspondence: Record all communications with your insurance company, including emails and letters. Make notes of all phone conversations, including the time, date, and who you spoke with.

- Seek legal advice: If your insurance company refuses to investigate your claim, undervalues your damages, or acts in bad faith, you need a Morgan & Morgan Port St. Lucie insurance lawyer in your corner.

Should I Give a Recorded Statement to an Insurance Company?

Your insurer or the at-fault party’s insurance company may ask you to provide a recorded statement. Typically, an adjuster will ask you about details of your covered loss over the phone while the insurance company records your answers. Recorded statements can become problematic for claimants, as anything you say could be used against you.

Reasons why individuals should be careful about giving a recorded statement include:

- Insurance adjusters are trained to ask questions in such a way that could lead you to reveal information that is later used to deny or undervalue your claim.

- You may not yet have all the information you need to provide an accurate and complete statement of your accident or other loss.

- You could inadvertently admit fault during a recorded statement.

You are not obliged, by law, to provide an insurer with a recorded statement and can refuse to do so. However, if you agree to a recorded statement, be honest and accurate. If specific questions make you uncomfortable or give you the impression that an adjuster is trying to manipulate you, decline to answer.

Consider contacting an insurance lawyer in Port St. Lucie who can help you understand your rights and obligations under the terms of your policy and protect your interests throughout the claims process.

What Should I Do if the Insurance Company Refuses to Investigate My Claim?

Insurance companies must investigate and process valid claims promptly and reasonably. Depending on the type of claim, an adjuster investigates and collects information as soon as practical. Investigations must be carried out promptly to ensure no vital evidence is lost. Moreover, you could lose a fair settlement if your insurer refuses to timely investigate your claim.

When an insurance company refuses to investigate a claim without good reason, it may act in bad faith, which is illegal. If this has happened to you, Morgan & Morgan’s insurance lawyers in Port St. Lucie could help you recover your initial claim amount plus damages from the insurance company.

Handling insurance disputes on your own can be frustrating and exhausting. Moreover, insurers often employ teams of lawyers who do nothing but fight claims. To give yourself the best chance of prevailing against an insurer, hire an attorney familiar with local laws and regulations.

Morgan & Morgan is everywhere for everyone. Our insurance lawyers in Port St. Lucie understand the local court system and can provide you with personalized attention and support. They can take the time to understand your specific situation and work tirelessly to recover what you deserve.

How Does the Statute of Limitations Affect My Insurance Claim?

The statute of limitations sets a time limit on when you can file a lawsuit. In the context of insurance claims, you have a certain amount of time to sue an insurance company if they have denied your claim or made lowball offers. The specific time limit depends on the type of case you bring.

For example, if you intend to sue your homeowners’ insurance, you generally have four years to do so in Florida. Since deadlines can vary, speak to an insurance lawyer in Port St. Lucie to ensure you know the best timing for your lawsuit.

What Is the Difference Between First-Party and Third-Party Insurance Claims?

A first-party insurance claim is made by the policyholder for a loss covered by their insurance policy. For instance, you would make a first-party claim if you sustained car damage and injuries in a crash and file a claim with your car insurance company.

On the other hand, a third-party insurance claim is made against another’s insurance policy for a loss the other party caused. For example, if another driver caused your crash, and you make a claim against their insurer, you are filing a third-party claim.

Can I Afford a Morgan & Morgan Insurance Attorney?

Morgan & Morgan believes you deserve the best legal representation regardless of your financial situation. Therefore, we don’t charge clients a dime upfront. Our fee is free unless and until we win and recover for you. Moreover, in many cases, an insurance company that lost its case must pay for the policyholder’s attorney’s fees.

Morgan & Morgan Wants to Help You Get a Fair Insurance Settlement

Morgan & Morgan knows that dealing with insurance companies can be frustrating and upsetting. However, don’t give up if you struggle to get what you deserve from an insurance company. Instead, contact us and tell us what happened. You deserve an adequate settlement for a valid claim, and we could help you get justice.

Morgan & Morgan has a track record of standing up to powerful insurance companies and helping people like you fight the big bullies. Our Port St. Lucie insurance lawyers want to help you navigate the complex world of insurance claims and fight for the settlement you need to pay your bills and get your life back on track.

Contact us now for a free, no-obligation case review to discover your options.