Results may vary depending on your particular facts and legal circumstances. The attorneys featured are licensed in Kentucky. For a full list of attorneys in your state please visit our attorney page.

OWENSBORO HURRICANE ATTORNEY

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorneys featured are licensed in Kentucky. For a full list of attorneys in your state please visit our attorney page.

Hurricane Lawyer in Owensboro, KY

Owensboro, the fourth largest city in Kentucky, is famous for its food and traditional bluegrass music. While it's a bustling area, it still retains the charm of a smaller city, and housing prices are below the national average, making homeownership attractive and attainable. Your home is likely the biggest asset you have. While everyone hopes that nothing goes wrong with their most significant investment, sometimes mother nature has other ideas.

Kentucky is prone to many natural disasters, including floods, tornadoes, wildfires, landslides, and severe storms. While hurricanes have never hit Kentucky directly, remnant tropical storms can substantially impact Kentucky homeowners. Two tropical storm remnants have caused major damage in the past decades. In 2008, the remnants of Hurricane Ike brought strong winds causing downed power lines, power outages, and roof damage, particularly to mobile homes. In 2017, the remnants of Hurricane Harvey brought heavy rainfall and winds, causing flooding and damage to residential and business structures.

The National Oceanic and Atmospheric Administration predicted that this year's Atlantic hurricane season would be above-normal with 14 to 21 named storms. Suppose remnants of a hurricane have damaged your Owensboro home, and you're having difficulties with your insurance company. In that case, you might be searching for the best hurricane lawyer in Owensboro, KY. Morgan and Morgan's lawyers are here to help you fight for your rights.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

When Should You Hire a Hurricane Lawyer?

You've been paying your homeowner's insurance premiums faithfully for years to protect your investment. Depending on the value and location of your home, these premiums are not cheap. Yet, when you contact your insurance company about storm damage, they're now giving you excuses as to why they shouldn't pay up. That's an infuriating situation to find yourself in, and we feel your pain. You've paid for this protection, and now you expect them to keep up their end of the bargain. It is, after all, a contract made between you and them.

Usually, homeowners that find themselves getting the runaround from their insurance company contact a hurricane lawyer to fight for them when they experience the following:

Claim denials - Insurance companies may deny storm damage claims for a variety of reasons. However, that doesn't mean it's the end of the road. Suppose you don't understand or agree with their decision. In that case, our lawyers will be able to help determine the reason and fight for you to get the payment you deserve.

Disagreements over coverage - If your roof was damaged and the roofing company says you need a new roof, but the insurance company will only agree to cover minor repairs, that leaves you in an awkward position. What happens when the next storm comes through and the subpar repairs fail, leaving you with even more damage? Our lawyers are experienced with how to handle disagreements over coverage and insurance industry practices.

Lowball offers - We understand that getting offered less than what you need to cover repairs and replacement of damaged belongings is insulting. Hiring a lawyer to negotiate on your behalf is extremely valuable as we're experienced with how insurance companies work. Their main goal is to make a profit. However, the success of their business should not be at the cost of your most valuable possession, your home.

Home owner's associations - An HOA has the fiduciary duty to act in the corporation's best interest. If the board of directors is in dispute with an insurance company over claims, they would be best served by hiring a hurricane lawyer to make sure the residents under the HOA are represented fairly.

Catastrophic damage - Remnant hurricane storms can cause catastrophic damage to your home. If you have significant damage, you're likely to have an uphill battle getting the compensation you deserve from the insurance company. They don't like to pay out on big claims because it hurts their bottom line. Legal representation from the get-go can significantly impact how much you get and how fast you get it. We are well versed in handling insurance claim negotiations and may be able to find opportunities you may overlook.

The statute of limitations deadline is approaching - In Kentucky, courts allow for a shortened statute of limitations for homeowner's claims for damage which can be as little as one year. Some people may not even realize their home was damaged after a big storm because regular people may not inspect their home inside and out and possibly may not recognize damage even if they see it. When the statute of limitations is a worry, our lawyers can swing into action quickly to make certain legal actions are filed in time.

The insurance company is acting in "bad faith" - When consumers make a deal with a company, they expect to be treated with respect and for their contract to be handled fairly. However, some insurance companies and adjusters are less than ethical. An insurance company is acting in bad faith when they use underhanded tactics such as delaying, not investigating, underpaying, unfairly denying your claim, or not providing a good reason for denial. In some cases, they may offer no justification for denying the claim. This is not playing by the rules, and there are laws that protect consumers from this abuse. If an insurance company is found to be acting in bad faith, you can bring a lawsuit against them.

Kentucky allows for both first-party and third-party bad faith lawsuits and additionally allows punitive damages for these claims. To receive punitive damages, a plaintiff must prove the insurance company acted with malice, committed fraud, or oppressed the plaintiff. Oppression under the punitive damage statute of Kentucky is defined as conduct specifically intended to cause cruel and unusual hardship.

What Are Common Reasons an Insurance Company Will Use to Deny a Hurricane Damage Claim?

When a natural disaster strikes and causes damage to residences, that's when people feel grateful to have homeowner's insurance. Feeling protected is why we pay those hefty premiums. However, receiving notice that your claim has been denied can be quite a shock. Still, when your claim is denied, you don't have just to sit and take it. A Morgan and Morgan hurricane lawyer in Owensboro, KY, can assist with restarting negotiations and look for new evidence to submit or mistakes you or the insurance adjuster made. Here are some common reasons insurance companies use to deny claims:

They determine the damage was preexisting - Insurance adjusters may claim storm damage was preexisting and therefore, they are not responsible for paying for the claim. Another tactic is to say the property wasn't well maintained, and that led to more severe damage. Every home or business will experience normal wear and tear, which shouldn't be used to deny a valid claim.

The policy does not cover the type of damage that occurred - The problem with hurricane damage is that it's a combination of high winds and heavy rains. Since flood insurance is required to be purchased separately through the National Flood Insurance Program, not every homeowner has it unless they live in a flood zone. Owensboro, KY, is subject to floods. An insurance adjuster may come to your property and say the damage was caused by flooding when actually it was heavy winds that caused your roof to come off and allow the rain to come in. In a case of severe damage, our hurricane lawyers will work with you to prove the damage was the result of high winds.

An error was made during the claim process - This is all too common. Unfortunately, the insurance company isn't going to go out of its way to let you know when you made a mistake. Instead, they'll just let you figure it out on your own and, in the meantime, frustrate you by outright denying the claim.

Your documentation wasn't satisfactory - How many of us have pictures of their home inside and out? Unless you're an insurance pro, you likely don't have this kind of documentation to prove what condition your home was in before and after the storm. However, this is a bogus tactic if a thirty-foot tree falls on your home, or flying debris causes a structure on our property to topple.

You didn't secure your property - This tactic can be infuriating, especially when you are faced with a severe storm. You may have been told to evacuate and didn't have time to go around boarding up your windows and securing outdoor objects that might become projectiles. Likewise, after the storm, you may not have realized you needed to take measures to ensure more damage wouldn't occur. Furthermore, after a heavy storm, tradespeople in high demand may not be able to get to your home right away to help you mitigate further damage.

While the insurance companies may deny claims for many reasons, that doesn't mean you're stuck paying for damages on your own. If you have a legitimate claim, you should be compensated for it, and if it requires filing a lawsuit, we're ready to help you with that. While the majority of lawsuits are ultimately settled out of court through negotiations, filing a lawsuit lets the insurance company know you mean business and are ready to fight for your rights as a consumer.

Why Hire Morgan and Morgan Hurricane Lawyers?

We understand you have lots of choices when looking to hire a hurricane lawyer in Owensboro, KY.

Plenty of lawyers talk about their successes. However, we have over 35 years of proof of our success right on this website. You'll see tens of thousands of success stories with over $30 billion recovered for our clients.Throughout our history as a law firm, we've worked to help ordinary people that find themselves caught up in unfortunate extraordinary circumstances. When you pay your homeowner's insurance, you expect that you'll be covered and your future protected should the unthinkable happen. When that's not the case, you need expert legal help to set things right. You don't have to fight on your own, and we don't require payment for our services unless we negotiate a favorable settlement or win the day in court.

There's no reason why you shouldn't get the help you need and the compensation you deserve. Contact us today for a free evaluation to take the first step towards resolving your homeowner's insurance issues.

Our Results

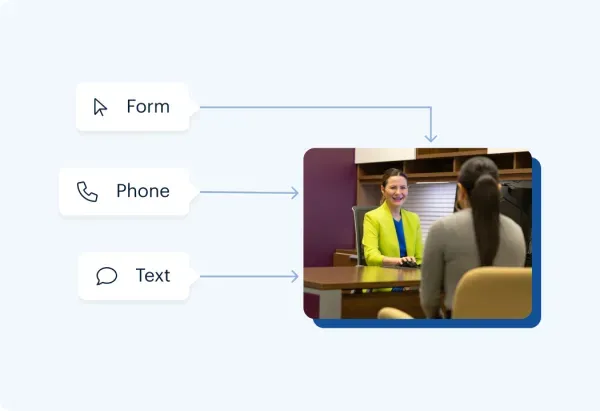

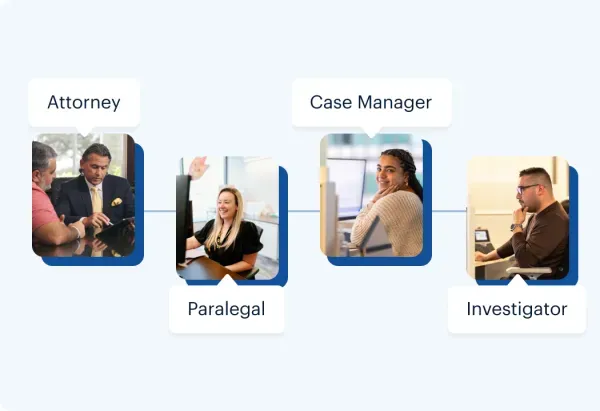

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.