Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

ORLANDO INSURANCE ATTORNEY

Insurers sometimes delay, underpay, or deny valid claims. We fight to get what you deserve.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Orlando Insurance Attorney

Dealing with insurance claims can be frustrating and overwhelming, especially when insurers deny, delay, or undervalue your rightful compensation.

In Orlando, residents and business owners often face these challenges after car accidents, property damage, or other unexpected losses.

At Morgan & Morgan, our Orlando insurance attorneys help clients navigate complex insurance policies and fight for the compensation they deserve. We handle claims disputes, negotiate with insurers, and pursue legal action when necessary to recover payments for medical expenses, property repairs, lost wages, and more. With over $30 billion recovered for clients nationwide, our team has the experience and resources to stand up to powerful insurance companies and protect your rights.

If you’re facing an insurance dispute in Orlando, don’t go it alone. Contact Morgan & Morgan today for a free case evaluation. We’ll fight to ensure you receive the coverage and compensation you deserve.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Our Results

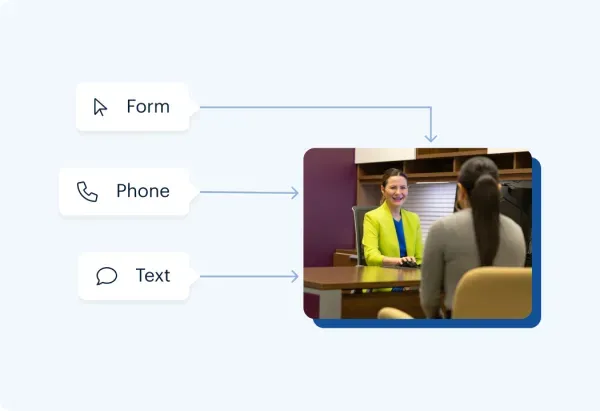

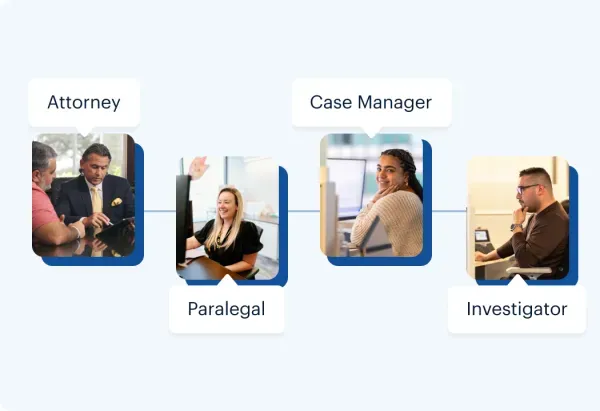

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.

What is "Bad Faith"?

Every insurance contract comes with a duty of good faith and fair dealing between insurer and policyholder. Even if the policy does not state as much, it is implied by legal tradition. Florida insurance companies have every right to request reasonable proof of claims, conduct investigations, question losses, and even deny or limit claims if it is warranted.

What they cannot do is engage in conduct that has no legitimate purpose but to intimidate policyholders, unfairly shave value from legitimate claims, or simply discourage policyholders from makings claims by making the process so difficult that it becomes more trouble than it is worth.

Some examples of bad faith conduct by an insurer include:

- Ignoring claims or other communications for policyholders

- Denying claims without conducting an investigation

- Misrepresenting the coverage the insured's policy provides

- Failing to provide a basis for claims denial

- Failing to promptly inform the insured that additional information is needed to adjust a claim

- Denying a claim or failing to promptly adjust a claim without a reasonable basis

Florida's Insurance Bad Faith Law

When an insurance company incorrectly denies or undervalues a claim, the policyholder may be able to sue to recover the amounts owed.

But when an insurer engages in the conduct discussed above, or denies or undervalues a claim without any reasonable basis for doing so, Florida's bad faith law provides additional penalties.

In addition to forcing insurance companies to pay over wrongfully withheld insurance proceeds, this law also allows Florida courts to levy punitive damages – damages designed to punish the insurer rather than simply to compensate the insured. These punitive damages can potentially be more than the amount of the underlying claim.

Contact a Florida Insurance Bad Faith Lawyer Today

Florida's insurance bad faith law is a worthy step toward holding insurance companies accountable for unfair claims adjustment practices. However, the law is also overly complex and imposes a number of difficult procedural requirements upon policyholders who seek to invoke it against their insurers.

Our Orlando insurance bad faith attorneys at Morgan & Morgan have studied this law from top to bottom and have used it to win a number of victories against major Florida insures.

If you are tired of being pushed around by your insurance company, contact Morgan & Morgan today at (407) 420-1414 or reach out to us online to receive your free case evaluation.