Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Kentucky. For a full list of attorneys in your state please visit our attorney page.

LOUISVILLE OVERTIME ATTORNEY

If your employer denied you overtime pay, we fight to recover your lost wages and ensure fair compensation for your work.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Kentucky. For a full list of attorneys in your state please visit our attorney page.

Louisville Overtime/Wage & Hour

Most Louisville employers treat their employees fairly and with respect. However, there are some employers who believe that their position gives them the right to do whatever they want, including denying wages and not paying workers for overtime hours. An employee may not know what to do or who to turn to for help. When this happens, our attorneys are ready to step in and fight for you.

At Morgan & Morgan, our wage and hour lawyers accept cases regarding a wide range of employment and wage-related issues for workers throughout the nation. In the last five years, our firm has handled more than 6,000 wage and hour lawsuits and recovered millions on behalf of our clients. We help Louisville workers who were wrongly denied overtime, underpaid, or forced to work off-the-clock recover compensation for lost wages. Our Louisville attorneys are dedicated to fighting for those who weren’t paid properly and are not afraid to take their cases to court to get the money they deserve.

If you were denied overtime pay or were not properly paid for your work, you may be able to file a lawsuit against your employer to collect compensation for unpaid wages. To find out if you have a case, contact our Louisville wage and hour attorneys today by filling out our free case evaluation form.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Our Results

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

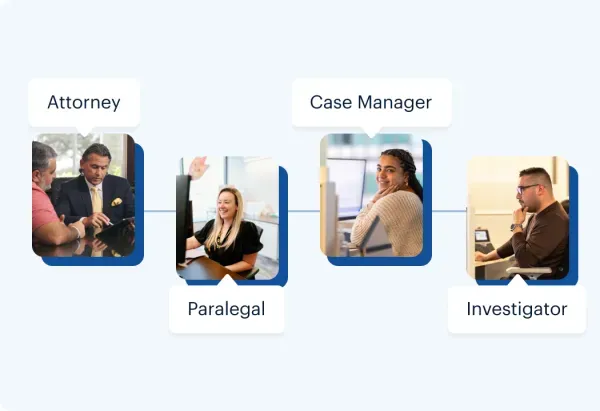

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.

Industries with Frequent Wage and Hour Violations

Our Louisville attorneys handle cases on behalf of workers in all fields; however, we’ve found that the following employees are more susceptible to wage and hour violations:

- IT workers;

- Service technicians;

- Installers;

- Sales representatives;

- Nurses and healthcare workers;

- Tipped employees;

- Oil and gas field workers;

- Call center workers;

- Personal bankers and mortgage brokers; and

- Retail employees.

If your job is on this list and you believe you were denied overtime or otherwise improperly paid, you may be able to file an individual lawsuit or a collective action lawsuit on behalf of yourself and other employees.

Cases We Handle

There are a number of ways in which your employer may shortchange your wages in violation of federal or state law. For example, your employer may claim that you can’t receive overtime pay unless you have permission to work extra hours or refuse to pay you for time spent doing certain work-related activities (i.e. putting on safety equipment, checking emails from home, going to before- and after-hours meetings). Below are examples of cases our attorneys handle and common violations we see in our practice.

The employer misclassifies the worker as an “exempt” employee. Some employees are considered “exempt”from overtime pay and other federal pay provisions. This means they are not entitled to overtime pay when they work more than 40 hours a week. Unfortunately, employees can sometimes be wrongly classified as “exempt” either because their employer doesn’t understand the law or is trying to avoid paying overtime. For instance, an employer may promote a cashier to “assistant manager” without changing the worker’s job duties to claim that he or she is an “exempt” manager and therefore not entitled to overtime wages.

The employer misclassifies the worker as an “independent contractor.” Independent contractors typically work on a contract basis for other businesses. They are considered self-employed and do not receive overtime pay. Our attorneys handle lawsuits against employers who have either intentionally or unintentionally misclassified their workers as independent contractors despite the fact that they meet the definition of an employee and should receive overtime pay.

The employer fails to pay the worker the minimum wage. The federal minimum was is $7.25 per hour, but some states have passed legislation enforcing a higher minimum wage. In Louisville, the minimum wage is currently $8.25. However, despite federal and state laws, some employees are often cheated out of the minimum wage. Day-rate workers and tipped employees are particularly susceptible to minimum wage violations because of how they are paid.

The employer doesn’t pay for all hours worked. Time spent working for the benefit of your employer — regardless of whether you’re on the employer’s premises — is considered compensable time and should be paid. Examples of compensable time include time spent:

- Checking emails from home;

- On-call;

- Turning on computers;

- Cleaning equipment;

- Putting on equipment;

- Undergoing security checks;

- Working through meal breaks;

- Attending training or safety classes; and

- Taking short breaks that last between 5 and 20 minutes.

If your employer isn’t properly tracking your work time, it’s possible you’re getting cheated out of overtime pay because your employer is not properly calculating how much time you worked per week.

The employer pools tips with non-tipped employees. Tip pooling occurs when tipped employees (e.g., waiters, busboys, bartenders, etc.) put their tips in a general “pool” that is later equally divided among tipped workers only. While these tips belong solely to tipped workers, non-tipped employees (e.g., the business owner, managers, cooks, etc.) may wrongly collect a portion of these tips. As a result, the tipped workers’ hourly pay may fall below the required minimum wage.

The employer averages two workweeks together to claim the worker didn’t work overtime. Some employers average workers’ hours over the course of two weeks, which is illegal and can cheat workers out of overtime pay. For example, an employee who works 30 hours one week and 50 hours the next could have his hours averaged and his paycheck shows that he worked 40 hours each week. As a result, he never receives overtime pay for the 10 hours he worked in the second week.

The employer offers “comp time” instead of overtime pay. Instead of giving their workers overtime pay, some companies may give their workers “comp time” or hours that can be used toward vacation or sick time. Only state and local government employees, however, can legally receive “comp time” in lieu of overtime pay.

The employer pays Chinese overtime or “half-time.” Chinese overtime, also known as a “fluctuating workweek” or “half-pay” program, is when workers receive overtime pay at a rate one-half times their typical hourly rate. There are, however, strict criteria the employee must meet to be eligible for “half-time.” These criteria include that the employee’s hours fluctuate between weeks, the employee receives a set salary that does not change with the number of hours he or she works, and that the worker and employer have a “clear mutual understanding” that the worker will receive the same amount each week regardless of hours worked. Some employees receive half-time without meeting these criteria, resulting in underpaid overtime and minimum wage violations.

Can I Be Retaliated Against for Filing a Wage and Hour Lawsuit?

It is illegal for employers to retaliate against workers who file wage and hour lawsuits. Examples of retaliation include firing or demoting workers, reducing hours, assigning undesirable shifts, cutting down job duties or purposely giving false performance reviews that negatively affect workers’ positions. If you were retaliated against after filing a lawsuit for lost wages, you may be able to file a separate, individual lawsuit against your employer. Contact our Louisville lawyers at Morgan & Morgan today to see if you could have your job reinstated or recover compensation for a pay cut resulting from employer retaliation.