Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

HOW TO COLLECT PIP INSURANCE IN JACKSON, MS

Car crashes can derail your life. We've helped thousands of people recover—physically, financially, and emotionally—after an accident.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Car Accident PIP Insurance Lawyer in Jackson, MS

Experiencing a car accident in Jackson, MS, can be quite traumatic. Your vehicle is likely to be damaged, and you may have experienced a physical injury as a result of the collision.

If the injury is serious, you are probably dealing with mounting medical expenses and lost wages from being out of work. You may be suffering from ongoing back pain, a fracture, or a traumatic brain injury.

These injuries can result in lots of time spent in a doctor’s office undergoing physical therapy or other types of treatments. You may be relying on your loved ones for simple tasks such as driving, cleaning the house, or cooking.

A personal injury protection (PIP) insurance plan can help to cover medical costs, lost income, and emotional distress.

Under state law, those who live in Mississippi are not required to carry this type of insurance as part of their automotive coverage. However, those who choose to carry it may receive reimbursement for expenses incurred as a result of a car wreck, including medical costs and lost wages.

In some cases, PIP may be difficult to collect from insurance providers. It’s important to work with a legal advisor when seeking PIP reimbursement from your insurance company. They can help you to receive the compensation you are entitled to.

Attorneys at Morgan & Morgan are experienced in collecting PIP reimbursement for their clients who have been injured in a car accident. Get in touch with our easy-to-use contact form to set up a free case review.

What Is PIP Insurance?

Personal injury protection (PIP), also known as no-fault insurance, helps cover expenses such as medical bills from an injury and lost wages after an accident.

In Mississippi, PIP insurance is not required for all drivers who operate motor vehicles. However, drivers may elect to have it as additional coverage on their insurance policy. It’s helpful to drivers who want peace of mind that they will have some form of reimbursement should they be involved in an accident.

Bodily injury liability insurance is typically the first line of insurance that consumers think of when they consider reimbursement for medical expenses after a car accident. However, this type of liability protection is designed to cover medical expenses for the other driver involved in the wreck. It does not cover the policyholder.

A PIP plan is designed especially for the policyholder and any passengers in their vehicle at the time of an accident. It can prove especially helpful in cases of a single-car accident or if the other driver involved in a collision does not hold any bodily injury liability coverage.

The amount of PIP that you can carry will vary on your insurance policy. Some drivers carry $10,000, while others may ask for much more. PIP policies offer no-fault benefits to the insured, residents in their household, and passengers in the event of an accident.

PIP repayments are allowed to those affected by the accident, no matter who is at fault. PIP does not cover any property damage, so other parts of the insurance policy will be needed to reimburse costs to repair your vehicle and any other items damaged due to the wreck.

What States Require PIP Insurance Policies?

While Mississippi does not explicitly require drivers to carry PIP insurance, many other states do. Personal injury protection insurance is required in states that operate on a “no-fault” system for car accidents.

“No-fault” simply means that the state has a law requiring PIP insurance that pays for reimbursement of medical costs and other expenses regardless of who was responsible for the collision.

Current “no-fault” states that require PIP insurance include:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Other states that require PIP insurance but do not use the “no-fault” model include:

- Arkansas

- Delaware

- Maryland

- Oregon

The remaining states (including Mississippi) allow their residents to decide whether they want PIP insurance coverage. Those who decide not to carry it will need to rely on their healthcare coverage for medical costs that arise as the result of an accident.

Other options may include pursuing a claim with the other driver’s insurance policy if the other driver was responsible for the accident. An attorney practiced in motor vehicle personal injury law can provide victims of car accidents with their legal options.

What Does PIP Cover?

An individual involved in a car accident in Jackson, MS, may experience physical injuries that result in back pain, fractures, or other wounds.

Drivers who carry PIP coverage in their policy can lean on the coverage for reimbursement for certain costs associated with injuries sustained in a wreck. They may also receive other monetary compensation. Common items that PIP covers include:

Medical Expenses

PIP can be used to reimburse policyholders for medical expenses they incur as the result of a car accident. PIP will also extend to passengers who were in the policyholder's vehicle at the time of the collision.

Typical injuries sustained in a motor vehicle accident include back pain, whiplash, fractures, and brain trauma. All of these types of injuries can require significant medical care that is expensive. PIP can help reimburse those costs, protecting you and your passengers from serious financial damage.

Loss of Income

Those who are unable to work as a result of serious injuries or other trauma may receive lost wages through a PIP policy. This is especially helpful if you will be unable to work for a long time. Even if you have vacation or sick time available through your job, a PIP policy will pick up the cost of your time away from work.

Living expenses can add up quickly, and without a guaranteed source of income, it may be easy to fall behind on regular expenses. A PIP policy can help mitigate these costs until you’re back on your feet.

Funeral Expenses

If the policyholder or a passenger in the vehicle was killed as a result of the collision, PIP coverage can cover the expenses associated with a funeral, burial, or cremation.

While PIP is most commonly needed for medical expenses and lost wages, some severe collisions may result in loss of life. Compensation for funeral expenses from a PIP policy can be particularly helpful if the individual does not have life insurance.

Survivors’ Loss

Dependents of the policyholder may be able to claim PIP insurance coverage to make up for the loss of income as a result of the policyholder’s death from a collision. This can help offset living expenses during an especially traumatic time.

Oftentimes, a probate process is required before an individual’s estate may pass to their beneficiaries. This proceeding may take time, and PIP survivor’s benefits can help ensure your loved ones have a source of income directly after an accident.

Essential Services

If you’ve been injured in a way that prevents you from performing regular daily activities such as cleaning your house or taking care of your children, you may be able to request reimbursement from your PIP policy for essential services.

For example, you may need to hire a housecleaner or childcare provider to take care of the tasks you can’t handle. Your PIP coverage will cover the costs until you recover from your injuries. This can allow you to focus on healing while preventing new injuries, such as increased back pain or other problems.

What Is Not Covered by PIP?

Personal injury protection doesn’t cover certain items, such as:

- Property damage

- The other driver’s injuries

- Injuries incurred from an accident where you were committing a crime

- Injuries sustained during a crash where you were being paid to drive

Other types of insurance policies may cover these types of damages, including bodily injury or property damage liability insurance.

If you find that your policy (or the other driver’s) doesn’t cover these types of damages, you will want to seek legal assistance from an attorney at Morgan & Morgan. We will help you determine what your recourse may be.

What Types of Injuries Are Commonly Sustained in Car Accidents?

Car accidents can result in a variety of different injuries. Unfortunately, after a collision, it’s common not to realize you’ve received an injury until some time has passed.

This is known as the adrenaline effect. The shock of an accident can increase your adrenaline, reducing the amount of pain that you would normally feel if you were injured.

Common injuries sustained in an accident include:

- Back pain associated with herniated discs or muscle injury

- Whiplash of the neck or back

- Concussion or skull fracture

- Sprains or fractures of the wrist, arm, or leg

- Cuts from debris

- Internal organ damage

It’s important to see a physician as soon as possible after a car accident. They will design a treatment plan if required. They may also provide you with medication to reduce any pain or swelling that you may be experiencing as a result of the wreck.

How Do I Collect PIP Insurance?

You'll need to file a claim to receive reimbursement for medical costs, lost wages, essential services, or any other damages allowed through your PIP insurance plan. This starts the PIP compensation process and will enable you to collect the damages you need in a timely manner.

The amount that you can recover will be limited to the maximum PIP coverage that you have or to the estimated costs of your monetary damages. If the PIP coverage does not cover all of the expenses you have incurred as a result of the car accident, you may want to pursue a personal injury claim.

An experienced Jackson, MS, personal injury attorney at Morgan & Morgan will review your case to determine whether another claim may be necessary.

What Limits Apply to a PIP Policy?

Depending on state law and the policy adopted by the insurance provider, PIP insurance policy limits may be either monetary or verbal. Under a monetary policy limit, a ceiling is placed on the amount of damages that may be recovered. This is the maximum amount that a policy will pay out.

If the policy has a verbal threshold, the car accident victim will not be able to recover any expenses unless their injuries are considered disfiguring, life-threatening, or catastrophic.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Our Results

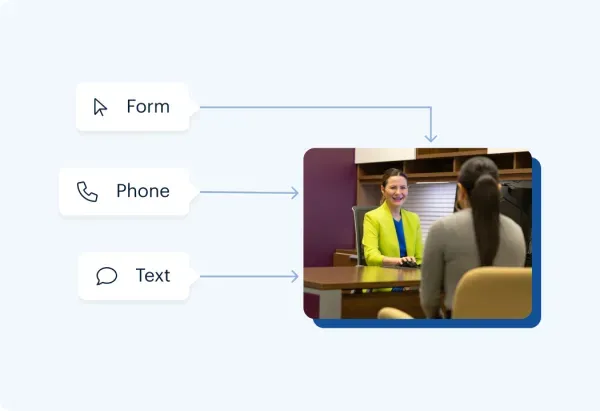

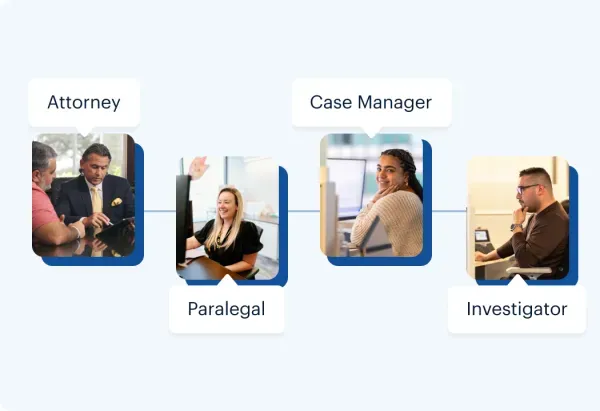

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.

What Happens if My Insurance Provider Is Uncooperative?

Unfortunately, insurance providers may be uncooperative in certain cases. This is especially true if you don’t provide the information that they need to approve your claim or if your claim appears to be frivolous. It’s important not to undermine your claim in any way or downplay your injuries.

A skilled attorney will help you prepare your claim and ensure that you have the documentation needed for the insurance provider. If your claim is clear and you have evidence showing the injuries you sustained as a result of the accident, you’ll be more likely to receive reimbursement under your PIP policy.

Will I Need to Pay for Representation Upfront?

Attorneys at Morgan & Morgan work on a contingency fee basis, which means that there are no upfront costs to you. In our initial consultation with you, we’ll review the facts of your case to determine whether we can take it forward.

If your case results in damage compensation recovered from your insurance provider, we will receive a percentage of it for our fees. We do not collect any money unless you do.

Can Morgan & Morgan Assist Me With Recovering Damages?

An experienced attorney with Morgan & Morgan will assist you in recovering expenses associated with a PIP claim. Our team is highly knowledgeable in car accident law and knows how to work with insurance adjusters.

We will help you assemble the documentation associated with your claim and submit it for reimbursement. Our attorneys will negotiate with insurance companies for you when necessary. If your claim is denied, we can work to explore other legal options that may be available to you.

No one should have to suffer financially as a result of a car accident, especially if it wasn’t your fault. We want to help you receive the money you are entitled to so that you may move on and recover from your collision. Use our online form to schedule a free case review today!