Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

HOW TO COLLECT PIP INSURANCE IN FT. LAUDERDALE, FL

Car crashes can derail your life. We've helped thousands of people recover—physically, financially, and emotionally—after an accident.

Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Car Accident PIP Insurance Lawyer in Fort Lauderdale, FL

If you’ve recently been injured in a motor vehicle accident in Ft. Lauderdale, FL, you may be experiencing ongoing treatment associated with fractured limbs or other trauma. Serious injuries can lead to spending lots of time in a physician's office, undergoing physical therapy, or other regimens required to recoup your health.

The injuries you’ve sustained from an accident can lead to mounting medical bills, loss of wages from being unable to work, and emotional distress. Dealing with the repercussions of a collision can require a lot of effort from you and your loved ones who are supporting you.

Policyholders who own vehicles in Florida are required to carry personal injury protection (PIP) insurance. Personal injury protection insurance allows drivers to receive reimbursement for their medical costs and lost wages directly from their insurance company.

However, collecting PIP insurance can be difficult, especially if the provider denies your claim. To ensure that you receive all of the PIP compensation that you are entitled to, you need legal assistance.

If you’ve been injured in a car accident in Ft. Lauderdale, FL, you may be eligible to collect money through a PIP policy. Contact the attorneys at Morgan & Morgan to schedule a free consultation and discuss your accident today.

What Is PIP Insurance?

Personal injury protection (PIP), also known as no-fault insurance, helps cover expenses such as medical bills and lost wages after a wreck. In Florida, PIP insurance is required for all drivers who operate motor vehicles.

PIP is typically an add-on for an individual’s insurance policy. Florida state law requires drivers to have a minimum of $10,000 of PIP insurance. This policy must pay no-fault benefits to the insured, residents in their household, drivers, and others in the event of an accident.

Personal injury protection repayments are allowed to those affected by the accident, no matter who is at fault. PIP does not cover any damage to property; this should be covered by other parts of your car insurance coverage (or the at-fault driver’s policy).

What States Require PIP Insurance Policies?

A small portion of states that operate on a “no-fault” system for auto accidents within the U.S. require PIP insurance policies. “No-fault” simply means that the state has a law requiring PIP insurance that pays regardless of who was responsible for the collision.

Current no-fault states that require PIP insurance include:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Other states that require PIP insurance but do not operate according to the no-fault model include:

- Arkansas

- Delaware

- Maryland

- Oregon

The remaining states allow their residents to choose whether they want PIP insurance coverage. Drivers may decide not to carry it on their policy. However, if they are injured in a collision without it, they will likely need to rely on their healthcare coverage to ensure that medical bills are paid.

What Does PIP Cover?

Individuals who are experiencing injuries as the result of a vehicle collision may be eligible to receive PIP benefits if they carry them on their insurance policy. PIP coverage will pay benefits up to the amount that the driver has paid for on their policy, if needed. Common items that PIP covers include:

Medical Expenses

The first item that PIP covers is medical costs for those who were injured in the accident. This may include the driver or their passengers.

Injuries from vehicle accidents can require significant medical care that is expensive, especially if you don’t have health insurance.

Work Loss

If you are unable to work as a result of injuries incurred during a car accident, you may receive lost wages through your PIP policy. This can be especially helpful if you won’t be able to work for a significant period of time.

Living expenses can add up quickly, and if you don’t have a source of income, you may not be able to meet them. PIP can help support you as you recover from the collision.

Funeral Expenses

If the driver or another person was killed as the result of the car accident, PIP coverage can help cover the costs of a funeral, burial, or cremation. While PIP is most commonly associated with medical costs and lost wages, collisions may be more severe and result in loss of life.

Coverage for funeral expenses from a PIP policy can be especially helpful if the deceased person did not have life insurance.

Survivors’ Loss

If you have dependents, they may claim your PIP insurance coverage to make up for the loss of income as a result of your death from a collision. This can help offset living expenses while they recover emotionally and until any assets in your estate are passed to your beneficiaries through the probate process.

The amount they can receive will be determined by the amount of the policy.

Essential Services

While you recover from your injuries, PIP may also provide supplemental income for activities that you’d normally perform.

For example, if you normally clean your own house and take care of your young children, PIP can cover the costs associated with hiring people to perform these activities for you.

This can reduce the stress you have when you aren’t able to take care of them yourself. It can also prevent you from sustaining additional injuries, such as increased back pain.

What Is Not Covered by PIP?

Personal injury protection won’t cover any of the following:

- Damage to your vehicle

- Injuries to individuals who aren’t in your vehicle

- Wounds incurred while committing a crime when driving a vehicle

Other types of insurance policies may cover these types of damages, including bodily injury or property damage liability insurance. If the wreck resulted in property damage or other injuries, you should check your policies to see if they may be reimbursed. An experienced attorney at Morgan & Morgan can assist you.

What Types of Injuries Are Commonly Sustained in Car Accidents?

A motor vehicle accident can result in a number of different injuries. Due to the effects of adrenaline, you may not realize that you have been wounded until a few hours after the collision.

The shock of an accident can increase your adrenaline, leaving you in a heightened state where you don’t feel the pain associated with some types of injuries until a few hours later.

Injuries commonly sustained in an accident include:

- Bruising and contusions

- Whiplash

- Concussions

- Broken bones

- Internal bleeding

Make sure to visit a physician as soon as possible following a car wreck. If you have any injuries, the doctor will design a treatment plan if needed. They may also give you medication to relieve any pain or swelling that you may be experiencing as a result of the wreck.

What Should I Do Immediately After a Car Accident?

The time immediately following a collision in Fort Lauderdale, FL, can be stressful and emotional. You may be dealing with injuries in yourself or others, and you may not know exactly how to handle the wreck. Following a few steps right after an accident can help you if you later decide to pursue a personal injury claim or need to collect PIP.

Call for Medical Assistance if Anyone Is Injured

Immediately following the collision, check yourself and your passengers for serious injuries. You should also ask anyone else involved in the collision if they have been hurt. If someone needs to go directly to the hospital for treatment, call for an ambulance.

Contact the Police

In most cases, police must be contacted so that they may investigate the cause of the crash. They will also organize the scene of the car accident to clear any wreckage from the road.

Once they have discussed the accident with involved parties and inspected the damage, they will provide each driver with a copy of a police report. The police report can be helpful if you decide to pursue a PIP claim.

Take Photos of the Scene

Even though you’ll have a copy of the police report, you should still prepare documentation of the wreck. You can take photos of injuries and damage to your vehicle, as well as pictures of license plates and other cars involved in the accident.

Ask bystanders for their contact information. They may need to answer questions regarding the accident for your insurance claim.

See a Doctor as Soon as Possible

It’s important to go to the doctor as soon as you can after a wreck. While you may not think you’ve been injured, sometimes wounds may become apparent within a few hours or the next day following an accident.

A doctor will run tests and conduct an examination to determine whether you have any injuries. This is especially important if you will need to claim PIP for medical expenses or lost wages.

How Do I Collect PIP Insurance?

To collect PIP insurance, you’ll need to report the accident to your insurance provider. This starts the process and will assist you in obtaining the funds you need in a timely manner. The insurance company should compensate you for personal monetary damages incurred as a result of the wreck.

Damages may include medical expenses, lost wages, or the costs of essentials. The amount that you can receive will be limited to the maximum amount of your policy coverage, as well as the expenses incurred.

If your PIP coverage will not cover all of the costs you have sustained as a result of the accident, you may want to pursue a personal injury claim. An experienced Ft. Lauderdale personal injury attorney at Morgan & Morgan can review your case to determine whether another claim may be necessary.

What Limits Are Common With a PIP Policy?

PIP policies typically have limits that prohibit claims from being paid unless they comply with certain rules. Under a monetary limit, reimbursement is only paid up to the amount that the policy covers.

For example, if you have a $15,000 monetary limit on your PIP policy, that is the maximum amount it will reimburse you for medical expenses or lost wages.

If your plan has a verbal threshold, no compensation will be paid unless your injuries are severe. Policies that follow verbal limitations usually will not reimburse medical expenses or lost wages for minor injuries. However, injuries that are catastrophic or long-lasting will typically qualify.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Is It Common for Insurance Providers to Be Uncooperative?

Unfortunately, yes. Insurance providers may not be working in your financial interests when it comes to claims. They also receive a number of frivolous claims, so they may be likely to require significant amounts of documentation before agreeing to reimburse you under your PIP claim.

It’s important not to give too much information to an insurance representative. Once you’ve decided to pursue a PIP claim, allow your attorney to handle as much of the communication as possible. They will work in your interest to ensure you receive the compensation you are eligible for.

Will I Need to Pay for Representation Upfront?

The compassionate and experienced personal injury attorneys at Morgan & Morgan work on a contingency fee basis. This means that there are no upfront costs to you.

During your free case review, we will work to understand the facts of your case. If we decide to accept it, we do not collect any money unless you do. Our earnings are a percentage of the compensation you receive from your insurance provider.

How Can I Get Assistance From Morgan & Morgan?

Morgan & Morgan will help you assemble the required documentation for your PIP claim, including the police report, evidence of medical expenses or bills you’ve incurred, and your doctor’s notes. We will also negotiate with your insurance company to ensure that you receive the compensation that you are entitled to.

If your PIP claim is denied, we can explore other potential options that may be available to recover appropriate monetary compensation as a result of your accident. Set up a free consultation today with our caring and compassionate legal team. We’re standing by to assist you.

Our Results

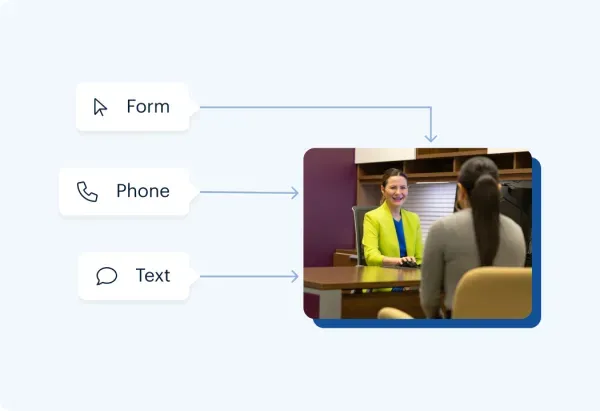

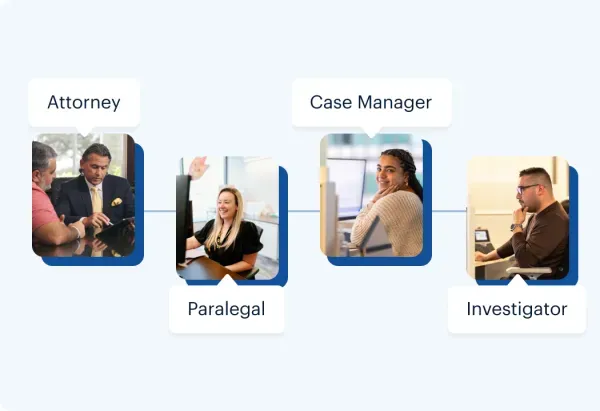

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.