Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel. Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

CHICAGO CAR INSURANCE LAWYERS

Car crashes can derail your life. We've helped thousands of people recover—physically, financially, and emotionally—after an accident.

Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel. Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Injured in Illinois? Know your rights.

If you or your loved one has had their claim dismissed by a car insurance company, Morgan and Morgan car insurance attorneys might be able to help. Our law firm boasts powerful legal resources to fight for your rights. We have dealt with countless insurance companies and know the tactics they use to avoid paying what they owe.

Let's discuss some of these tactics below.

Common Tactics Car Insurance Companies Use to Deny or Devalue Claims

When you get injured in a car accident caused by another party's negligence, their insurer might use any of the following tactics to deny or undervalue your claim:

Constantly Calling You After an Injury

If the insurance company keeps calling you after the injury, do not think they care so much about you. On the contrary, chances are they are trying to catch you off guard. This is because when you get injured in a car accident, chances are you will not be in a position to make the right decisions.

Insurance companies know this and will likely call you multiple times to convince you to sign a quick settlement. This tactic is also meant to deny you the opportunity to evaluate your injuries.

Certain injuries, such as internal body injuries, usually take time to show. That explains why these companies will try to contact you, hoping you sign a settlement agreement before the full extent of your injuries begins to show.

Offering a Quick Settlement

When the insurer calls you to offer a quick settlement, you will likely think they care so much about you. But that is not always true. The reason for doing this is to ensure you settle for less than the actual value of your claim. When they offer the settlement, they will also have you sign a release of settlement agreement.

A release of settlement agreement, also known as a “release” is a document that absolves the insurance company of the responsibility of compensating the injury victim beyond the settlement that has already been agreed upon.

Say your claim was worth $100,000, and you agree to a quick settlement offer of $10,000. The insurer will have you sign a release of settlement, meaning you cannot turn back and file a new lawsuit against them for the same accident, even if you discover that the settlement was way below what you were entitled to.

This can be heartbreaking, especially if you have medical bills and other expenses to take care of after the accident. There is a possibility that you might sink into debt when you accept a lowball offer from an insurance company after an accident.

For example, if you did not work while recovering from the injury, you will likely not have enough money to pay your bills. Your landlord will not stop asking for rent just because you got injured. The same applies to your credit cards and other important bills.

The only way you may be able to file a new lawsuit against the insurer is if you can prove that the settlement you accepted derived from fraud on the insurer's side. Unfortunately, this is not usually the easiest thing to prove. In fact, some attorneys do not take such cases if the injury victim has already accepted the settlement and signed the release of settlement agreement.

Requesting a Recorded Statement

If the insurer asks you to record a statement, they may be trying to find a reason to blame you for the accident. Naturally, you may think that the insurer wants to ensure that you receive full compensation for your injuries. Or, you will probably think that requesting a recorded statement is part of the compensation process.

Remember, claims adjusters mostly work directly with insurance companies. Even if they sound friendly on the phone, they will always put the insurer's interests first. This could mean tricking you into revealing information you should not reveal, especially without the help of an attorney.

For example, the claims adjusters might ask you how you feel after the accident. This sounds like an innocent question from someone who cares about you. In fact, chances are you will feel loved and appreciated, especially after an accident.

But did you know that this could also be a trick question designed to make you reveal things you should not? For instance, if you say that you are feeling fine and then later develop complications due to the accident, the insurance report will show that you actually said you felt okay after the accident.

Even though insurance companies know that certain injuries take time to show their symptoms, they will still use our statements against you. And if they cannot succeed at dismissing the entire claim, they will at least find a way to devalue it.

Using Delay Tactics

Delay tactics can lead you to accept settlement offers that do not match the actual value of your injuries. Here is how it works:

When you have a claim with the insurer, they might not process it immediately. Rather, they will delay the process, citing different reasons. While doing so, they will hope that you reach the point of desperation where you would be willing to accept just any settlement offer. And as mentioned before, they will convince you to sign the settlement agreement, absolving them from further liability.

Disputing Treatment

This is usually the coldest tactic insurance providers use to avoid paying what they owe an injury victim. Let's say you are injured in a car accident and require multiple surgeries. After the surgery, the doctor might recommend additional treatment such as physical therapy.

For this reason, the at-fault party's insurance will not want you to receive further treatment. This is because additional treatment requires more money, one thing they would love to avoid.

To evade spending more money on treatment, some insurance companies even hire a team of doctors to study the injuries and establish why the victim does not deserve the prescribed treatment. This is heartless, but the truth is that insurance companies do not care.

They will do anything to protect their interests. In this case, their primary interest is to reduce their spending.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

Our Results

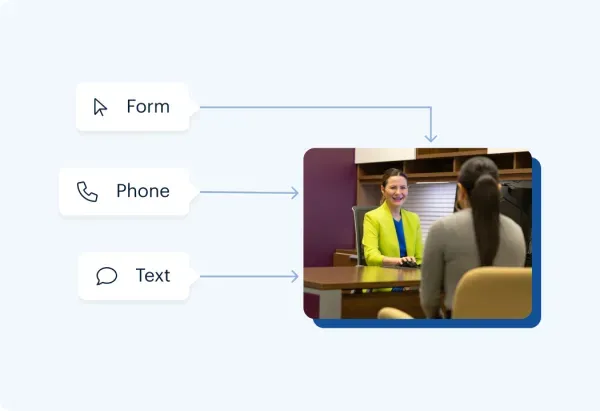

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

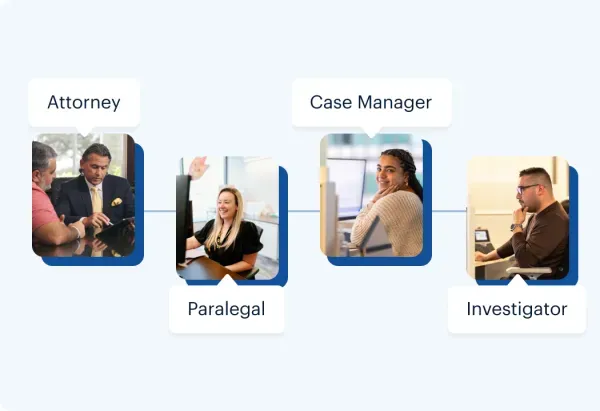

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.

How Can Morgan and Morgan Help?

If an insurance company dismisses or devalues your claim, Morgan and Morgan car insurance attorneys might be able to help. While there are many auto insurance lawyers in Illinois, Morgan and Morgan stand out when it comes to fighting for the rights of individuals injured due to someone else's negligence.

Here is what makes us different:

Experienced Car Accident Insurance Attorneys

Morgan and Morgan boast years of experience when it comes to fighting for the rights of individuals who have been injured in car accidents. For this reason, we know the different tactics insurance companies use to deny their accident victims the compensation they need and deserve. When you contact us for a free case evaluation, we will determine whether you have a valid case against the insurer.

If your case is valid, we will review the insurance provider's actions. And if we suspect any wrongdoing, such as a blatant denial of a valid claim, we will help fight for you, ensuring you receive the compensation you need.

We Have the Resources to Fight for You

Insurance companies make millions of dollars every year in profits. Therefore, they can easily afford some of the best defense attorneys in Illinois. This explains why you need to work with an attorney with powerful legal resources to overpower the other party's legal muscles.

At Morgan, we are the largest personal injury law firm in Illinois and throughout the country. In addition, we have the legal resources to fight for you. We are not just one of those law firms that agree to settle for anything just to end the case. Rather, we believe in fighting for what our clients truly deserve. If the offer does not reflect what our clients deserve as compensation for their injuries, we will simply not accept it.

That is because we have powerful legal resources to fight. Law firms or solo attorneys that settle for just any settlement amount do not usually have the resources to fight, and that is why they would rather settle for a lowball offer. At Morgan and Morgan, we have the resources needed to take on some of the biggest names in the insurance industry.

We Have a Proven Track Record

If a law firm's track record is anything to go by, then you can rest assured that you are in the right team when you choose to work with us. This is because Morgan and Morgan has a solid track record of winning these kinds of cases.

To put things into perspective, as of August 2022, we have helped our clients recover more than $30 billion as compensation for different kinds of injuries, including car accidents. This tells you one thing; we are not the kind of law firm that is all talk without action. Instead, we back our words with facts. Our results prove that we know what we are talking about.

Where Do I File a Claim If I Got Injured in a Car Accident in Illinois?

If you got injured in a car accident in Illinois caused by the other driver, you could file a claim with their insurance company. Illinois is an at-fault state when it comes to car accidents, meaning the other driver's insurance provider is responsible for compensating the accident victim.

Contact Morgan and Morgan car insurance attorneys for a free case evaluation if you have suffered significant injuries. We may be able to recover more.

How Long Do I Have to File a Claim After a Car Accident in Illinois?

In Illinois, the statute of limitations for car accidents is two years from the date of the accident. Since you have a tight deadline to beat, it is advisable to contact an attorney as soon as possible if you or your loved one has suffered significant injuries. An experienced attorney will help you beat deadlines you didn't know existed.

How Much Money Do I Need to Hire a Morgan and Morgan Car Insurance Attorney in Illinois?

Zero. Morgan and Morgan charge their clients on a contingency basis. This means they only get paid if they win the case. If they lose, they do not get paid. So if you or your loved one has a dispute with the other party's insurer, we will help you without any down payment.

How Long Does the Insurance Company Have to Settle My Claim?

In Illinois, insurance companies have up to 45 days to settle a claim. Similarly, they have up to 15 days to respond to the claim. If the insurer does not respond within 15 days, contact a Morgan and Morgan car insurance attorney immediately. They might be able to help.

How Can I Contact Morgan and Morgan Car Insurance Attorney in Illinois?

To contact a Morgan and Morgan car insurance lawyer in Illinois, fill out our free case evaluation form. Alternatively, call our Illinois office at 312-706-0550 to speak with one of our representatives about your injuries.