Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel. Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

CHARLOTTE CAR INSURANCE ATTORNEY

When a car accident happens, most people assume their insurance company will have their back. But the unfortunate reality is that many Charlotte drivers find themselves battling their own insurer after a crash, facing denied claims, lowball settlement offers, or unexplained delays just when they need help the most.

Cases will be handled by attorneys licensed in the local jurisdiction. Cases may be associated with, or referred to, other law firms as co-counsel or referral counsel. Results may vary depending on your particular facts and legal circumstances. The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Where Can I Find the Best Car Insurance Attorney in Charlotte, NC?

When you are learning how to drive, North Carolina requires you to study the rules of the road and demonstrate proficiency in driving. North Carolina also guides you through most of the process of getting your license and makes it relatively easy to register your car.

But one major aspect that North Carolina does not educate new drivers on is understanding how the insurance process works. Because of this, car accidents can be a source of confusion for new and old drivers alike. That is where an experienced car insurance attorney who is well-versed in the car insurance process can help.

Our car insurance attorneys at Morgan & Morgan can guide you through this process and will fight zealously to get you a fair settlement in your car insurance case. Reach out to our team through our contact form immediately if you have been in a car accident in Charlotte, NC, to get a free case evaluation.

Car Insurance Can Be Complicated

It is particularly surprising that new North Carolina drivers are not guided on how car insurance works since every driver in the state is required to have car insurance while driving a car.

If the state requires you to be insured, it seems reasonable the state would also teach you to understand the insurance process, or require you to demonstrate an understanding of the process before getting a license. Instead, North Carolina allows individual insurance companies to instruct you about the process.

Often, this means that most people don’t know how it works until after they need to make their first claim. It is only then that many North Carolina drivers learn that the car insurance process is complicated and unfriendly to people making claims.

Car insurance companies control almost the entirety of the claims process, and claimants like you can feel helpless under the overwhelming power of an adversarial insurance company. When faced with this, you will probably find yourself asking, “Where can I find the best car insurance attorney in Charlotte, NC?”

Fortunately, car insurance attorneys are no strangers to insurance companies controlling the claims process.

Insurance Companies Control the Car Insurance Claims Process

While insurance companies are regulated, the car insurance claim process faces minimal oversight. And car insurance companies take advantage of this limited oversight to pay as little compensation to claimants as possible.

If the process is unfair or you are treated unfairly during the process, you have limited redress options. Hiring a car insurance attorney from Morgan and Morgan is your best option when the insurance company is unfair to you during the claims process.

The Claims Process Can Be Overwhelming

Almost every part of the car insurance claims process is stacked against you. As soon as you initiate your claim, agents will begin asking for information and documentation.

Documentation and Investigation Take Time

Most of the questions may seem reasonable enough. But many are designed to elicit information that can be used to deny or reduce the compensation for your claim.

Documentation can also potentially be used against you, but it also serves a second purpose. The more documentation the insurance company asks for you, the more time you have to spend finding and submitting it.

Each delay frustrates the claimant and increases the likelihood that the claimant will drop the claim. A dropped claim is one that effectively costs the insurance company nothing.

If you continue with the claim, the insurance company will assign an agent to investigate the claim. Most of this investigation will be done without your input, but you may be required to answer more questions or provide the investigator access to your damaged vehicle or approve communication with your doctors.

These are small inconveniences, but they add up, especially when you are recovering from an injury after a car accident and need money quickly. Furthermore, the investigator might take weeks to complete an investigation, and the claims process will not continue until the investigation is complete.

Uncertain Outcomes

Despite those potential delays and inconveniences, you can’t even be certain the insurance company will approve your claim. And if your claim is denied, you will need to rely on the appeals process to get the denial reversed, a process typically controlled by insurance companies.

Even if your claim is approved, there is no guarantee you will get paid as much money as you should receive. Just as the insurance company has almost total control of the claims process, it also has near-total control of the valuation of that claim.

For example, an insurance company might decide that certain expenses or costs are not covered, or that they are covered for less than the actual cost. And just like when a claim is denied, the primary way to reverse these decisions is to go through the appeals process.

With this complicated process that the average person may simply not understand, insurance companies can pay significantly less than they should on many car insurance claims. Representation by an experienced Morgan & Morgan car insurance attorney is the best way to navigate the claims process and get paid fair compensation.

150,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

How can a Charlotte car insurance lawyer support me?

At Morgan & Morgan, we understand the strategies insurance companies use to protect their bottom lines, as we’ve been going up against them for decades. From the moment you bring us on your case, we work to level the playing field by controlling communication, investigating the facts, and demanding fair treatment under North Carolina law.

Our first step is to cut off direct contact between you and the insurance adjusters. Why? Because anything you say to the insurer, even something innocent, can be used against you later. We take over that conversation to protect your rights and prevent any missteps.

What steps should I take to investigate my claim?

Insurance companies often conduct their own investigations, but these are not always impartial. Your attorney will perform an independent investigation to uncover all evidence that supports your claim. This includes gathering photos, repair records, medical reports, and witness statements that the insurer might otherwise ignore or downplay.

And if your claim has already been denied, that doesn’t mean the fight is over. Whether the denial was based on a supposed lapse in coverage, disputed liability, or vague “insufficient documentation,” we can appeal the decision or file a lawsuit if necessary.

How do I know whether I should settle or go to trial?

One of the most significant questions clients ask is whether to accept a settlement or proceed to trial. A fair settlement can help you recover more quickly, but if the insurer refuses to make a reasonable offer, we won’t hesitate to escalate the matter. Our experienced attorneys are licensed to practice in North Carolina courts and have a strong track record of holding insurers accountable in both settlement negotiations and trials.

Sometimes, just knowing that you have legal firepower on your side encourages the insurer to offer a better deal. If the case does go to trial, we’ll stay by your side the entire way and fight to maximize your recovery.

What if I need money fast?

We know that bills don’t stop just because your claim is delayed. If you’re struggling with medical expenses or lost wages after a car accident, we can help connect you with community resources or short-term financial assistance. In some cases, your attorney can issue a letter of promise to your medical providers, allowing treatment to continue while your claim or lawsuit is pending. That way, you don’t have to choose between recovery and survival.

When should I contact a lawyer?

Ideally, you should talk to a lawyer before you even file your insurance claim. Early involvement enables us to preserve evidence, establish clear expectations, and prevent costly mistakes from the outset.

However, even if you’ve already filed and been denied, it’s not too late. We can step in at any stage to file appeals, negotiate on your behalf, or prepare for trial. Our attorneys will keep you updated every step of the way, explain your options clearly, and make sure you don’t miss critical deadlines under North Carolina law.

What do unfair insurance practices look like?

Bad faith happens when an insurance company delays, denies, or underpays your claim without a valid reason. It can also include refusing to investigate a claim properly, failing to return calls, or offering settlements that don’t reflect the full value of your damages.

Some common signs include:

- You’re asked for unnecessary or duplicate paperwork.

- Your calls go unanswered for weeks.

- Your adjuster refuses to explain why your claim is delayed or denied.

- You’re pressured to accept a quick, lowball offer.

If any of this sounds familiar, a lawyer can step in and hold the company accountable under state and federal laws that prohibit bad faith conduct.

How do I choose the right car insurance attorney in Charlotte?

You don’t need a massive legal team downtown to get great representation. Morgan & Morgan offers national resources with North Carolina-licensed attorneys who are familiar with the intricacies of insurance law in Charlotte. We’ve recovered over $30 billion for clients nationwide, and we handle insurance disputes with care, including denied claims, low settlement offers, and delay tactics.

Our attorneys work on a contingency fee, meaning you only pay if we win.

How can Morgan & Morgan in Charlotte help me?

Insurance companies bank on the idea that you’ll give up or settle for less than you deserve. But you don’t have to face this process alone.

Whether you’ve been in a crash, had your claim denied, or just feel overwhelmed by the fine print and legal jargon, Morgan & Morgan is ready to stand by your side. We’ll take on the legal heavy lifting, advocate for your best interests, and fight for the compensation you need to move forward.

Fill out our free case evaluation form today and find out how a Charlotte car insurance attorney can help you take back control.

Our Results

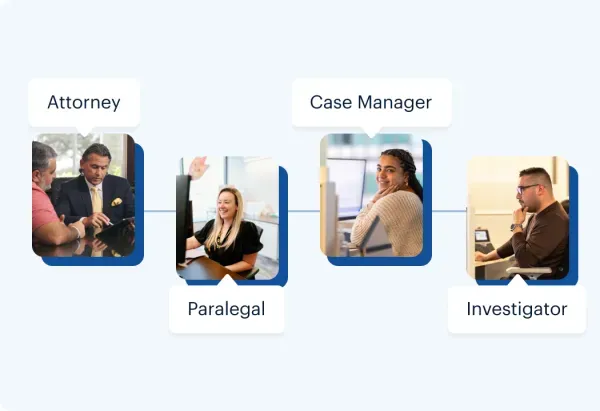

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Local Care

Backed by America’s Largest Injury Law Firm.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

served1,000+

Attorneys across

the country1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Learn More

Injured and not sure what to do next?

We'll guide you through everything you need to know.