How the Fair Labor Standards Act Affects Restaurants and Fast Food Businesses

Injured?

If you work in a restaurant or fast food business, you have important rights under the Fair Labor Standards Act (FLSA).

These businesses are legally required to pay you fairly, follow tip rules, and protect young workers, no matter how busy or fast-paced the job may be.

Let’s break down what the law says about your pay and workplace protections.

When the FLSA Applies to Restaurants and Fast Food Businesses

The FLSA covers restaurants and fast food establishments if:

- They have annual sales of at least $500,000 across one or more locations, or

- You handle goods that move in interstate commerce (sometimes even simple tasks like processing credit card payments).

If either applies, the employer must comply with FLSA wage, overtime, and youth employment rules.

Minimum Wage and Overtime Pay Requirements

Employers must pay:

- At least the federal minimum wage of $7.25 per hour, unless an exemption applies

- Time-and-a-half overtime pay for every hour worked over 40 hours in a workweek

Important:

Employers cannot deduct costs like uniforms, walkouts, or cash register shortages if doing so would lower your pay below minimum wage or overtime rates.

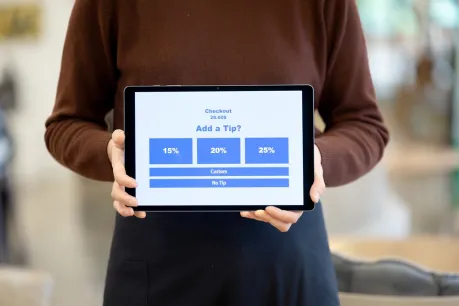

Tip Credits and Tipped Employees

If you work in a tipped position, like a server, bartender, or busser, tips can count toward meeting minimum wage requirements.

Here's how it works:

- Employers must pay at least $2.13 per hour in direct cash wages.

- Tips must make up the difference so that your total hourly earnings reach at least $7.25 per hour.

- Employers must allow you to retain all your tips, unless a valid tip pool is in place.

Reminder:

Employers cannot deduct from your wages if it brings your wages below the minimum wage when claiming a tip credit.

Youth Employment Rules for Restaurant and Fast Food Jobs

Additional FLSA rules protect young workers.

If You're 14 or 15 Years Old

- You cannot work more than:

- 3 hours on a school day

- 18 hours during a school week

- 8 hours on a non-school day

- You can only work between 7:00 AM and 7:00 PM, except during the summer (until 9:00 PM).

- Allowed tasks include cashiering, bagging orders, cleaning, and office work; however, tasks such as cooking, baking, and hazardous work are not permitted.

If You're 16 or 17 Years Old

- You can work unlimited hours in jobs not considered hazardous.

- You cannot operate dangerous equipment, such as meat processing machines or commercial mixers.

- You generally cannot drive on public roads unless you're 17 and meet specific conditions.

Food Credit for Meals Provided by Employers

Employers may offer meals at cost and deduct that amount from your wages.

However:

- They cannot claim a wage credit for discounts on food.

- Reduced-price meals do not count toward your minimum wage.

Common Wage Problems in Restaurants and Fast Food

Several issues come up often in the restaurant and fast food industry:

- Uniform Costs: If your employer requires a uniform, they cannot charge you for it in a way that reduces your pay below minimum wage or overtime rates.

- Tip Credit Violations: Employers cannot deduct uniform costs, walkout losses, or other charges if they claim a tip credit under Section 3(m) of the FLSA.

- Overtime Violations: Some employers misclassify workers as "exempt" to avoid paying overtime. You must meet specific legal criteria (under 29 CFR Part 541) to be truly exempt — just having a job title like "manager" isn't enough.

Important: If you are eligible for overtime, you should be paid 1.5 times your regular rate after 40 hours, no exceptions.

Think Your Rights Are Being Violated? Morgan & Morgan Can Help

Whether it’s making sure you’re getting paid enough for overtime or ensuring your tips are properly handled, understanding the rules will help you protect your paycheck.

If you think your employer isn’t following the law, the employment attorneys at Morgan & Morgan can help make sure you're getting the pay you deserve. Get started today with a free case review.

This information is based on fact sheets provided by the DOL.

We've got your back

Injured?

Not sure what to do next?

We'll guide you through everything you need to know.