Targeted by Identity Theft? Our New York City Data Privacy Lawyers Can Help

Injured?

Identity theft doesn’t always feel real until it hits home, when strange charges show up on your bank statement, debt collectors call about accounts you never opened, or you’re denied credit for no apparent reason. In a city as fast-paced and digitally connected as New York, identity theft is more than a personal violation; it’s a financial and legal emergency.

If you’ve been the victim of identity theft, knowing what to do next can be overwhelming. Your credit, reputation, and even your peace of mind may be at risk. That’s where legal guidance comes in.

The Real-World Impact of Identity Theft in NYC

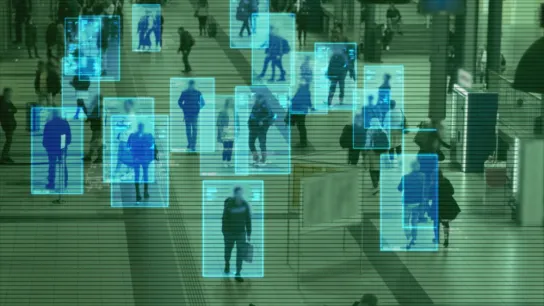

Identity theft is more than just someone using your credit card. In New York, cases often involve stolen Social Security numbers, fraudulent tax filings, false employment records, and even misuse of medical or biometric data. Criminals can obtain this information through hacking, phishing scams, stolen documents, or individuals sharing sensitive information on social media.

Once they have access to your personal details, they may:

- Open credit cards or loans in your name.

- Drain your financial accounts.

- File fraudulent tax returns.

- Obtain medical services under your identity.

- Commit crimes while posing as you.

Some victims don’t realize what’s happening until long after the damage is done. Unfortunately, even after taking immediate steps such as freezing credit cards or changing passwords, the effects can linger for years.

Identity Theft and New York Law

New York penal law treats identity theft seriously. Charges range from misdemeanors to felonies, depending on the extent of the harm. First-degree identity theft, the most severe, can carry a prison sentence of up to seven years. In addition to criminal penalties, civil lawsuits can also hold individuals, companies, or institutions accountable when their negligence allows your information to fall into the wrong hands.

In some cases, identity theft victims may be eligible to sue:

- Financial institutions that failed to protect personal data

- Creditors who continued to collect on fraudulent accounts

- Employers who mishandled sensitive information

- Third parties who improperly shared your personal details

Civil identity theft claims can result in compensation for financial losses, reputational damage, emotional distress, and other related damages.

What Legal Action Can Accomplish

If your identity was stolen, filing a civil lawsuit may help you recover more than just peace of mind. Depending on the circumstances, you may be able to seek compensation for:

- Unauthorized purchases and financial losses

- Damaged credit and loan denials

- Loss of job opportunities

- Medical bills tied to fraudulent care

- Legal fees for clearing your name

- Emotional distress and mental anguish

In some cases, identity theft lawsuits also pursue punitive damages, especially when institutions failed to uphold their duty to protect consumer data.

When the Crime is Digital, the Fallout is Personal

One of the most frustrating parts of identity theft is how long it can take to unravel. Even if the person who stole your information is never caught, you may still have a strong legal case against other parties who played a role, intentionally or not, in compromising your privacy.

That’s especially true in situations involving:

- Data breaches: Companies that fail to secure customer data may be liable under both state and federal law.

- Negligent institutions: Banks, lenders, healthcare providers, and even schools can be held accountable for weak cybersecurity or improper data handling.

- Improper access or misuse: Individuals who use your information without permission, whether coworkers, acquaintances, or strangers, can be sued in civil court.

At Morgan & Morgan, we’ve pursued major data breach and privacy-related class actions, recovering tens of millions of dollars for affected consumers nationwide. Our work includes settlements against corporations like Morgan Stanley, Google, and Citrix, all for failing to protect sensitive information.

How Identity Theft Affects Your Credit and Financial Life

In a city where credit is everything, from apartment rentals to job screenings, a damaged credit report can have long-lasting effects. Identity theft often results in:

- Drops in your credit score

- Inaccurate negative entries on your report

- Denied loans or higher interest rates

- Difficulty renting housing or passing background checks

- Ongoing issues with tax filings or government benefits

Rebuilding your financial profile after identity theft takes time, but legal support can accelerate the process. A lawyer can help dispute fraudulent charges, work with creditors, and hold responsible parties accountable for the damage caused.

Identity Theft Isn’t Just a Crime; It’s a Civil Wrong

While identity theft is often prosecuted in criminal court, victims also have civil rights. New York residents can pursue lawsuits against liable entities under theories such as:

- Negligence

- Breach of fiduciary duty

- Breach of contract

- Publication of private facts

- Invasion of privacy

These claims can be handled in state or federal court, depending on the nature of the theft, the location where the incident occurred, and whether federal laws such as the Identity Theft and Assumption Deterrence Act or the Fair Credit Reporting Act apply.

What to Do If You Suspect Identity Theft

If something feels off, suspicious charges, unfamiliar accounts, or debt collection calls, it’s worth taking action right away. Here are the steps New Yorkers should take:

- Alert your banks and creditors to freeze or investigate accounts.

- Change your passwords, especially for financial, email, and utility accounts.

- Contact one of the three major credit bureaus (Experian, Equifax, TransUnion) to place a fraud alert.

- Request a copy of your credit report and review it for unauthorized activity.

- File a report with the FTC at IdentityTheft.gov.

- Report the crime to your local NYPD precinct, and request a copy of the report for your records.

- Document everything, including suspicious emails, transaction records, and communications with institutions.

- Schedule a consultation with an experienced attorney, especially if you have suffered financial harm or experienced institutional failure.

Protecting Children and Vulnerable Individuals

Minors and elderly individuals are frequent targets of identity theft, often because their credit activity is dormant or closely linked to caregivers. In New York, it’s essential for parents and guardians to monitor their children's and dependents' credit activity closely. If your child’s Social Security number has been misused, legal remedies may be available.

Preventing Identity Theft in a Connected City

While no one is immune to identity theft, you can take steps to reduce your risk:

- Avoid sharing personal info on public social media posts

- Use complex, unique passwords and two-factor authentication

- Shred sensitive documents before disposal

- Be cautious with online forms and public Wi-Fi

- Regularly review your credit report for suspicious activity

If you’re unsure whether your personal data is safe, or you’ve already experienced a breach, getting ahead of the problem can protect you from deeper harm.

What to Expect in a Case Review

When you speak with a lawyer at Morgan & Morgan about identity theft, the process starts with listening. We’ll ask for a summary of what happened, including when you first noticed the issue and who had access to your information. We may request documentation such as:

- Police reports

- FTC filings

- Credit reports

- Bank or transaction records

- Communications with lenders or institutions

This helps us assess who may be liable and what type of compensation may be possible.

We Stand With Identity Theft Victims in New York

Identity theft can feel like an invisible crime, but its impact is very real. From financial loss and credit damage to the stress of reclaiming your name, the road to recovery can be long, and no one should have to walk it alone.

At Morgan & Morgan, we understand how deeply identity theft can affect your life. We’ve taken on some of the biggest institutions in the country for mishandling consumer data, and we’re ready to do the same for New Yorkers who’ve been wronged. Whether your identity was stolen by a stranger, misused by someone you trusted, or leaked by a negligent corporation, we’re here to help.

Contact us today for a free case evaluation. You don’t pay anything unless we recover compensation on your behalf. This is personal, and we’ll fight to make it right.