It's Easy to Get Started.

The Fee Is Free™. Only pay if we win. Fill out the form to get started.

Free Case Evaluation

Personal Injury Lawyers

Fighting For You

With 35 years, 1,000 attorneys, and $30 billion recovered, we fight

to get you what you deserve. Start your free case review anytime by

text, phone, or online.

Fighting

for More

The Fee is Free,

Unless we win

Local Care +

National Power

The Right Firm for Big Wins

Insurance companies know us—and they know we fight for every dollar.

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances. The attorneys shown in these photos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

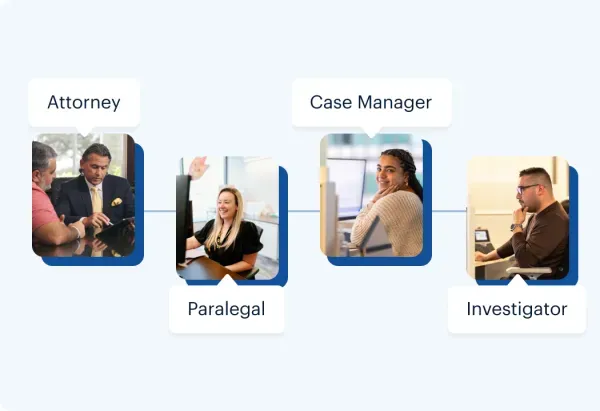

The Faces of Justice

“Our 1,000+ attorneys are whip-smart, bighearted, and passionate people who wouldn’t hesitate to go the extra mile for their clients.”

The attorneys shown in these videos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

The attorneys shown in these videos may not be licensed in your state. To find an attorney licensed in your area, please visit our attorney page.

Medical Treatments

Lost Wages

Pain & Suffering

100,000+ Five Star Reviews

The reasons why clients trust Morgan & Morgan.

Results may vary depending on your particular facts and legal circumstances. Based on select nationwide reviews.

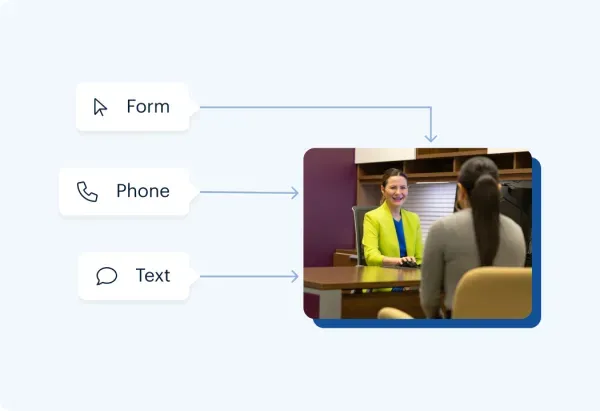

How It Works

Unsure what to do next? With 35 years of experience, our personal

injury lawyers will guide you every step of the way.

Contact Us 24/7 - It’s Free

Start your claim

Meet your dedicated attorney

Meet the attorneys

We fight for more

Learn more about the case process

Fighting for the People

There's a reason we're America's largest injury law firm:

our size means we can help more people, in more

places, and fight for the justice they deserve.

$30 Billion

Recovered for clients

nationwide700,000+

Clients and families

50 STATES

With attorneys ready

1

Click may change your life

The attorney featured above is licensed in Florida. For a full list of attorneys in your state please visit our attorney page.

Results may vary depending on your particular facts and legal circumstances.

Insights & Resources

Explore articles and resources to guide you through your options and making informed decisions after an accident.